Let's talk about : EV Apps on your phone

Charging networks, Payments, Communities, Aggregators - just too many apps & too much fragmentation

Edit : Jul 2025 : If you are looking for the latest edition of EV Charging Infrastructure Reports, then please follow these links :

ExpWithEVs Products and Services

This has mainly been a trip report kinda blog till now, but I'm widening the scope slowly, looking at other things from an EV driving experience.

If you are an EV driver who has driven on highways in India, you’ll be able to relate to this problem. One has to install too many apps on the phone to help with charging, community help, and whatnot. I believe we should be able to drive across the country in an EV just by using the car’s infotainment system, however, we are a long way away from that.

Please note, this article contains a lot of data and observations from the same. Collecting data and presenting is hard work. Please share the link to this article whenever quoting any data from here. As usual, if you’d like to just see the data and come up with your own inferences, skip the text, here’s the link to the data (3 sheets).

Let’s dive in :

Charging Apps :

I’ve driven over 10,000 kms in India in my MG ZS EV, and have used the public charging network a fair bit. The charging apps currently on my phone are - ChargeZone, ElectreeFi, EV Plugin Charge, Fortum C&D IN, goME, Jio BP Pulse Charge, iPlugged, Lion Charge, Magenta ChargeGrid, Relux Electric, Statiq, Tata Power EZ Charge, Xobolt and Zeon (14, yes).

Imagine remembering login credentials for these apps and maintaining wallet balances in each one of them.

The below charging networks combine to form roughly 1,000 DC Fast charging CCS2 guns spread out across India.

I’ve collected all the data (where accessible) and spread it out across three sheets. Sheet 1 gives you an overview of how the networks, their apps and their features. Sheet 2 shows state wise distribution of CCS2 guns. Sheet 3 provides a zonal distribution of these CCS2 guns.

Please note, I’ve only included CCS2 charging guns and not the number of charging stations or the number of CHAdeMO or Bharat DC standard connectors. This blog primarily focuses on electric cars. Most of them, in the passenger segment in India, support only CCS2, so that is the only standard being monitored here.

Additionally, the scope of this blog is focused only on fast chargers and not AC slow chargers. As an EV driver in India, I’d be happy with any kinda charging. But AC slow charging also works with a 3 pin 15A socket, thereby being universally available. AC Fast chargers are usually installed where the car owner stays / works at. With the growing number of EV users, this number is also bound to increase rapidly.

The analysis on Sheet 2 and Sheet 3 doesn't contain charger data from ElectreeFi or Magenta ChargeGrid because the option to filter CCS2 charging points didn't work correctly. It showed all kinds of AC charging as well as CHAdeMo or Bharat DC plugs. Thus their data is excluded. Once the apps have this option working well, I should be able to add these to the datasets in my next quarterly review. Random samples of CCS2 chargers from across networks have been verified via PlugShare.

Inferences from Sheet 1

In the context of highway driving, Tata and other players need to up their game and focus more on setting up chargers across major highways. There are fast chargers in cities. They are usually helpful in cases where someone is a local and doesn't have access to slow charging at home and needs a quick top up, or for folks who are taking an overnight pit stop and can't slow charge their car at the hotel they are staying at. However, having more DC fast chargers on the highways allows for movement of passengers across the country. While Tata has done a decent job at creating a country wide network of CCS2 chargers, they should prioritise installing more of them in public friendly spaces such as malls and food courts, rather than focus only in industrial areas or their own service centres.

It is remarkable that none of the apps allow for CarPlay support. I don’t use Android Auto, so I am unable to verify whether Android Auto works for these apps. Most of the EVs in the Indian market either have wired or wireless CarPlay / Android Auto. When on a road trip, you often have to check the live status of an upcoming charger, unless you’ve pre booked a charging slot. However, even with pre-booking as a feature, which I’ve used a couple of times in the past (link Delhi Mumbai return trip), you often end up pre-booking it while on the road, when you are an hour or couple of hours away. Thus having CarPlay / Android Auto support is a no brainer.

I also don’t understand why certain apps don’t allow users to review the charging stations. A lot of the Indian EV audience doesn’t use PlugShare, so many times one has to rely on the individual charging apps themselves for reviews of particular charging stations - which don’t allow reviews.

Also, listing down amenities is pretty handy. It allows one to plan their charging stops effectively. Ability to know whether there are eating options is a must have feature for these apps. Till the time the feature isn’t a permanent fixture on these apps, I would request the community to mention the same in their PlugShare reviews and in the reviews on these apps!

Some of the apps also require you to mention your car’s number plate before you can have a fully functional user experience on the app. It would be interesting to see if the app users are collecting this data to make charging easier for users or just to sell this data to a third party, or both.

Side note - the user experience of the Adani Gas EV, JioBP Pulse Charge, Relux and Xobolt is remarkably the same, with just different colour schemes.

Trivia : In India, approximately 31MW of power is currently being provided by the 1020 CCS2 Fast Charging guns mentioned above, thus at an average of 30.57kW / CCS2 gun.

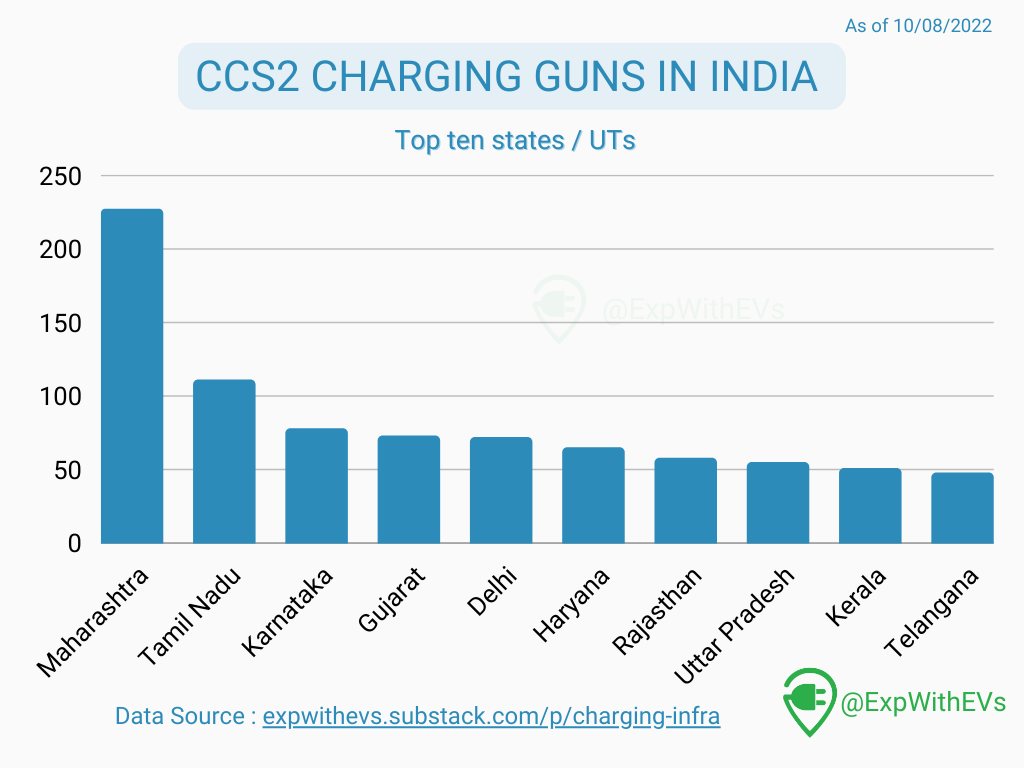

I’ve tried to summarise the Sheet 2 data in a single map.

First things first, hats off to Tata for rapidly expanding their charging infrastructure and being the leader by some distance. You cannot take a few hundred kms roadtrip in India without coming across a Tata charger. This is evident from the market share chart below.

Other charging networks are building up capacity but have a long way to go before they can become a viable alternative to Tata, except Zeon in Tamil Nadu. Maharashtra seems to be a favourite place to set up charging infrastructure for all operators. This could be either because of favourable EV Charger policies in Maharashtra or because of the high number of electric cars being sold in the state. In FY 21-22, as per the data obtained by TeslaClubIn from Vahan, Maharashtra sold 6477 electric cars followed by Delhi (2273), Kerala (2227) and Karnataka (1835). Maharashtra also has a ~1.3L subsidy if you buy a Tigor EV and ~1.5L subsidy for a NexonEV. First 10,000 4w vehicles are to be covered under this subsidy. There are rumours that the 10,000 eligible 4 wheeler electric vehicles are almost sold in Maharashtra, thus ending the subsidy till a newer scheme is announced.

Despite having a maximum number of electric chargers in Maharashtra, certain routes like Jalgaon to Amravati, Solapur to Nagpur are still not completely electrified. Outside of cities like Mumbai, Pune, Nashik, Aurangabad, Satara, Kolhapur - one doesn’t have many DC fast chargers in and around the cities.

Thus, a lot of work is still pending even in states like Maharashtra, which currently leads the scene by a huge margin.

Additionally, it seems that the infra companies have avoided placing any chargers in central / eastern / north eastern parts of India. This could primarily be because of lack of attractive EV policies in these states. I am pretty sure that once chargers are set up in these regions, there’ll be demand for EVs to charge in these states. Fast charging infrastructure has to be built ground up in these regions and will take massive amounts of investments. Tata is clearly taking an early lead in these regions. Even a state like West Bengal which has the bustling city of Kolkata has to rely just on Tata’s DCFC network.

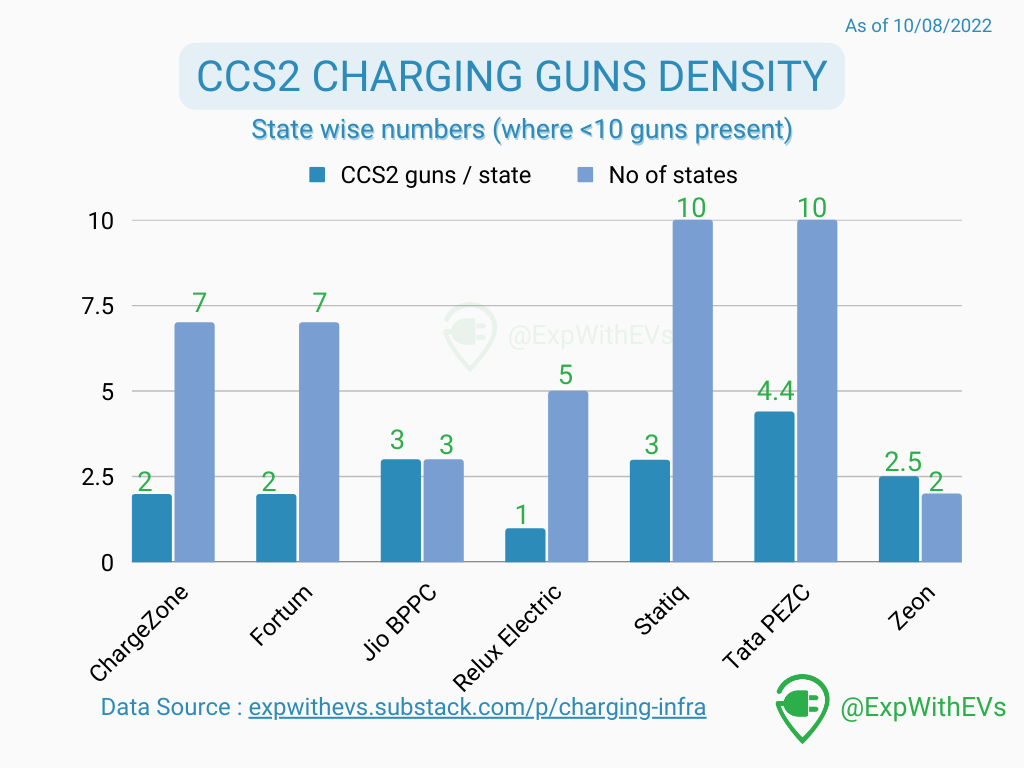

Only 27 states or union territories have a presence of at least one DC fast charger. Of which only 17 states or UTs have 10 or more than 10 fast chargers. Of these 17 states or UTs, Tata chargers have a presence in 16! All of this just means that there is enough work to be done in the country and hopefully the existing networks or newer ones will hasten the process of installation.

If we look at the charging infrastructure by zones, then there are almost equal numbers of charging guns in both North and West zones, with the South zone catching up quickly.

The West zone has three major players coming up - ChargeZone, Statiq and Jio BP Pulse Charge. Statiq and Zeon have a comfortable lead in North and South regions respectively for now.

Setting up DC fast chargers is capital intensive. Tata PEZC and JioBP PC are subsidiaries of Indian conglomerates. Statiq recently raised ~$25.7M from Shell whereas ChargeZone has raised around ~$10M from Venture Catalysts. There’s no public information available on whether Zeon has raised any funding, thus assuming that it is bootstrapped. Much kudos to Zeon for running a capital intensive business and being a regional leader!

FortumC&D India is an Indian subsidiary of an internationally listed company. Relux Electric too seems to be a bootstrapped startup which is quickly gaining ground.

The story of India’s EV Fast charging currently lies in the hands of Tata and it is upto them how they’d want to shape the industry. It would require massive investments by competitors to catch up with Tata, but the other apps can divide and conquer and establish themselves as at least strong regional players. Regional players make sense because electricity is a state subject and once the networks understand the know-how and bureaucracy of one state, it is easier to replicate their set up efforts across the state.

Go deep instead of wide!

Looking at the above data, and keeping Tata PEZC aside, we can see that ChargeZone, Zeon and Relux Electric have done a good job going deep in a limited number of states. Statiq, too, is almost there. The other players still need to increase the number of chargers in states they are already present in.

Here, we’re trying to see which operators are going wide. Again, keeping Tata PEZC aside, Statiq is the one company that is present in most states and with a higher number of CCS2 guns per state. Should Statiq continue with their investments in setting up charging infra, they would have the ability to go deep and wide both, thus forming a credible alternative to Tata PEZC in North and West regions.

Jio BPPC also has the ability to grow quickly based on the money that could be pumped in by Reliance if it wants, into its EV charging infrastructure plans.

Based on my experience, here are some points / features that should be looked at when talking about charging networks

RFID :

Usage of RFIDs is a great feature, but it is quick and easy only if the user experience is good. You don’t have to worry about your phone not having network coverage or you can still be on a call and put your car to charge, provided your wallet has enough cash. Another advantage is that you do save some time by using an RFID as compared to the regular app.

However, the charging networks should allow RFIDs to be used interchangeably, across multiple networks. As far as I know, only Statiq allows other RFID keys to be added to their app. The less RFID keys EV users have, the better it is for the environment. However, it still doesn’t solve the problem of having to maintain wallet balances across a multitude of apps.

Showing other chargers on your app :

I think it would be a great step for any charging network to take a lead here. Statiq has already started sharing VEEV chargers on their app. Preliminary research shows no direct connection between VEEV and Statiq, thus making this a unique and commendable step.

More apps should start showing chargers that are from other networks. This would allow users to spend more time on the aggregator app than individual charging apps. To gain more timeshare, the aggregator apps should also start allowing users to pay for their charging sessions on competitive chargers via their own network. This will truly enable an open network of chargers and payment options. The EV consumer will not have to manage multiple wallets across the various apps. Personally, I keep some balance in Tata wallet and Statiq majorly because of my travels in North India. I expect to add Zeon to that list when I travel to South India.

However, it would be great if the networks or any other 3rd party can do one or more of the following :

Enable UPI QR codes to accept payment on the charger screen itself. Seems difficult because most of the hardware is probably imported with no support for Indian payment gateways. However, this is the best method in case there is no support for RFID. The charger can also ask for lump sum payment upfront based on the estimated charging and can refund back the difference via UPI.

Have a single wallet that can work across multiple apps. With that single wallet, provide a single RFID key. That way you can charge across networks like a breeze and by just tapping on to the charger. Payment companies that already have a relationship with the networks are poised to disrupt this.

Authenticate and start charging based on the VIN (Vehicle Identification Number). Most of the hardware across chargers is similar and global in nature. India has limited models and it is pretty easy to make this into a policy at this stage. Where available, this is the most seamless way to start charging your car.

The US and EU markets have tackled point 1 by accepting payments via credit card. We still need to figure out an Indian solution to solve this uniquely Indian problem.

P.S. : There’s a company called Ecogears.in that promises to solve for point number 2. However, the pricing plans are not clear and there’s no clear communication on how they work with other charging networks. I have sent them an email enquiring about the same on Monday, 8th August 2022. The post will be updated once they respond.

P.P.S. : There’s another app called IonAge hosted by ionage.in . The app seems promising. The good thing that it does is that it shows chargers from multiple partners on the map. However, it doesn’t allow you to pay for the same. Nor do you get to know whether the charger is working or not. However, their website says that these features will be added soon.

The IonAge app has a good feature wherein you can choose the type of the car + put in your source and destination cities and it will show the places where you can stop and charge. You can also put in detours and it will plan accordingly. It also prefers DC fast chargers as compared to AC charging infrastructure, which is a great thing. However, it lacks the ability to pick the chargers. Nor does it allow you to plan for a multi day road trip (yet) with overnight halts. Looking forward to seeing what more they have in store!

Community related apps :

Community related apps are the first place you can go to, to resolve queries and doubts. The community is often quick to respond given day or night.

There are four community related apps that are on my phone. 2 out of 4 of these apps also serve other purposes.

Discord :

The PlugInIndia (PII) community has moved to Discord from Telegram but is still waiting for people to start coming in and to make it active. The inertia of moving people from Whatsapp → Telegram → Discord is just too damn high. However, Discord is a superior platform than the other two and hopefully the discussions will gradually become more active on these channels.

The PII community is one of the oldest communities and has the biggest reach in India. It is also the most active of all communities.

Pulse App :

Pulse is an interesting app that is trying to be Plugshare, ABRP and a curator of EV communities all at once. I’d rate them as doing a good job in replacing Plugshare, and a great job in curating the community. However, they are lacking quite a bit in trying to be India’s ABRP.

ABRP or ABetterRoutePlanner.com is popularly used to plan EV trips abroad. Right now, Pulse has predefined routes (they are adding more day by day) between any two cities. However, these routes are usually of less value because they are generic in nature and don’t consider your car’s range. They aren’t optimised and you can’t optimise them either. You also don’t get to pick and choose the chargers that you’d want to go to. It lacks an elevation graph which is also very important to get a range estimate.

Sadly, ABRP doesn’t have enough data on the Indian charging network and the vehicles, so it hasn’t started showing any routes yet. The sooner we can get there, the easier it will become to drive an EV in India.

The community building on Pulse is something that is also unique to it and is very helpful. You can enter an MG related channel only if you have an MG car. The admins are strict about it and verify it with your licence plate. This way you get dedicated access to MG owners pan India and can talk to them specifically about the car issues. They have such communities for almost all EVs, both 4W (4 wheelers) and 2W (2 wheelers).

It is trying to do many things at once, and if it can do this consistently, it will emerge as a market leader among all apps.

Plugshare :

The dearest of all apps. You can always rely on Plugshare to know if a charger is working or not. In India, it tries to do just this one thing, and it is doing it brilliantly. Almost all charger networks are already on Plugshare. Globally, they also have an option of ‘Pay with Plugshare’, however, this isn’t integrated with any charging network in India as yet.

Humble request - Please start posting reviews on PlugShare whenever you use a charging network / station. It helps the community because this is the first app anyone usually checks when wanting to know about chargers in an area. Ofcourse, you’d check the charger network’s app directly if you knew which chargers exist in the area.

Telegram :

Telegram is the home of most EV communities in India. You can expect relatively quick replies to your messages. Some of the notable communities are - PlugInIndia (focuses more on 2W and generic EV infra related), EVWorld (focuses on 4W), Tesla Club India (focuses on 4W) and India 4W EV Owners (relatively a quiet group). Please reach out to me if you are aware of any other active telegram groups related to electric vehicles!

YouTube :

There are a bunch of youtubers out there focusing mainly on EV related content. The most promising and regular content uploaders are PlugInIndia and Noise Faktory.

Please drop a comment or reach out to me on priyansevs@gmail.com if you think I’ve missed out on an app that you regularly use. Would be happy to add it! Also, please share the post with someone you know who drives a 4W EV. It may just help them!

Please follow us on Twitter and Instagram - @ExpWithEVs.

This piece can be re-published (CC BY-NC-SA) with a line mentioning ‘This was originally published on ExpWithEVs Substack’ and a link back to this page. In case of re-publishing, please alert priyansevs@gmail.com

Text and data - Priyans

Graphics and editing - Siddharth Agarwal

That's a great useful insight , Can you help me to understand how X CPO can invite other network /charger into his platform through OCPI protocol? My Question sounds little un constructive but I hope you understand what I am looking for ?