Edit : April 2025 : If you are looking for the latest edition of EV Charging Infrastructure Reports, then please follow these links :

2503 EV charging infrastructure

This is the third edition of the report on the state of Indian EV Charging infrastructure. This report contains 20 interactive charts, gifs and maps depicting 52 CPOs’ CCS2 and Type2 chargers, leading charge point operators in each zone, faulty chargers, infrastructure in major metro cities, and actual costs of charging over a combined driving of 42,000 kms in 16 months across the country.

The first report was published in August 2022 and the second report* in Feb 2023. The first report covered only CCS2 chargers with not all CPOs. The second report contained basic charging technologies, CCS2 chargers, Type2 chargers, Metro City concentration, and my wish list from CPOs.

The data from the above two reports is in the open source domain and available here and here.

* - The second report miscounted restricted Type2 chargers by Tata PEZC. I apologise for the error.

I’ve already covered the basics of charging technologies in my earlier post. You can read this section here.

As usual, if you want to skip the test and analyze the data yourself, here are the google sheets.

Sheet1 (CCS2 and Type2 CPO list, app download links, Charger distribution across states)

Sheet2 (costs of charging over 16 months of ownership, distributed CPO wise, AC home charging)

Here is my roadtrip sheet, which documents most of my fast charging sessions on roadtrips.

Acknowledgement

Collecting charger data from 50+ apps is a very time consuming and a difficult task. Lucky Agarwal, a young BBA student, helped with data collection. He is looking for an internship. Please reach out to him on his LinkedIn for opportunities.

I’d like to thank Siddharth Agarwal for the maps and the gifs. Lastly, I would also like to thank the CPOs for sharing the data with me.

Appeal

It takes a lot of hard work to prepare this kind of report. If you believe that the data and analysis has provided value to you, then please feel free to transfer whatever amount you like to my UPI id - expwithevs@ibl. International readers can buy me a pizza here.

I believe in Newslaundry’s model. Whoever pays for the data and content, gets served. If I rely on ads or sponsors from EV / EV adjacent businesses, then my inclination will be to serve them and not you, the reader. Reader contributions allow me to be independent and produce reports that are important to the EV consumers.

If you’d like more bang for your buck, then you can also support me by scheduling an air quality test by ActiveBuildings for your home or office for as low as INR 799/-. This is available in every major metro city in India. Do you feel better when you step out of the office for a walk / smoke? If yes, then you need to get your air tested ASAP. The pollution season is also upon us and you should know why testing your air quality is important.

Disclosure - I am the cofounder of ActiveBuildings.

Also, subscribe, if you haven’t already.

Let’s dig in

CCS2 Infra

The public CCS2 charging infrastructure has doubled in the last 6 months. The network has grown 4x in the span of a year.

This gif shows how the CCS2 charging infrastructure has grown in the last 6 months.

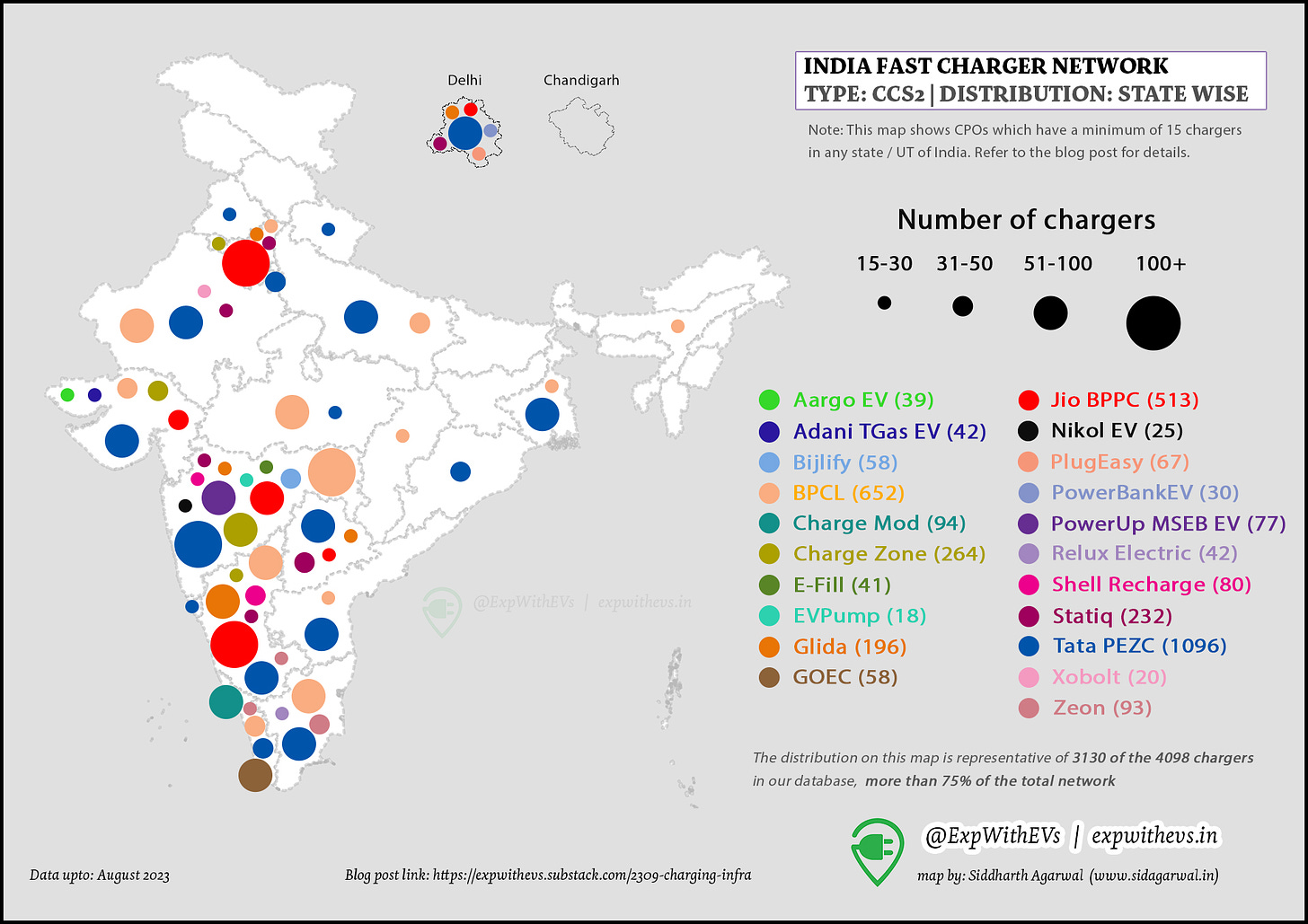

There are 21 CPOs with atleast 15 charging guns in a state / union territory (UT)!

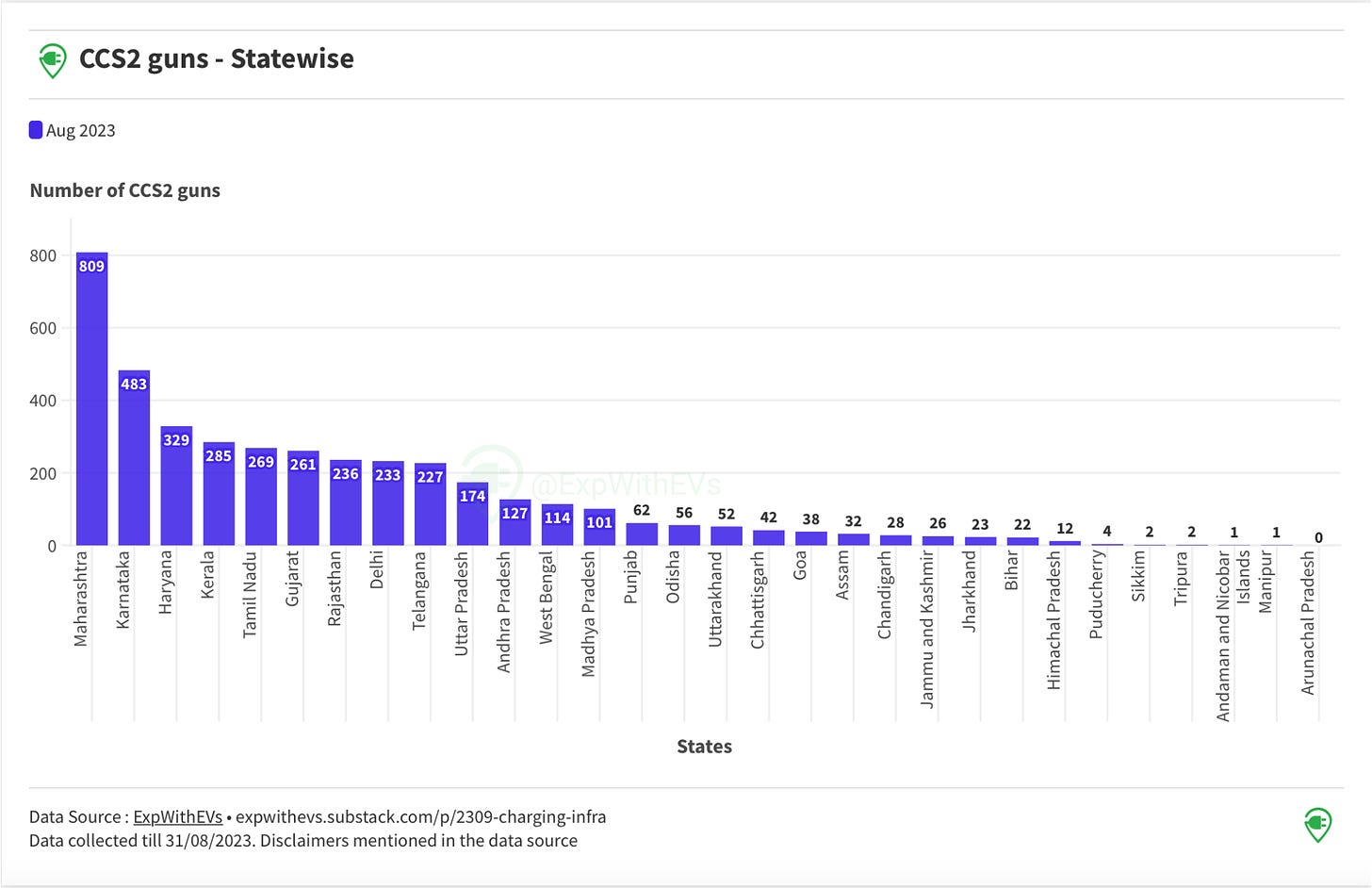

Here’s the statewise distribution of chargers.

Interactive chart for Figure 3 is here.

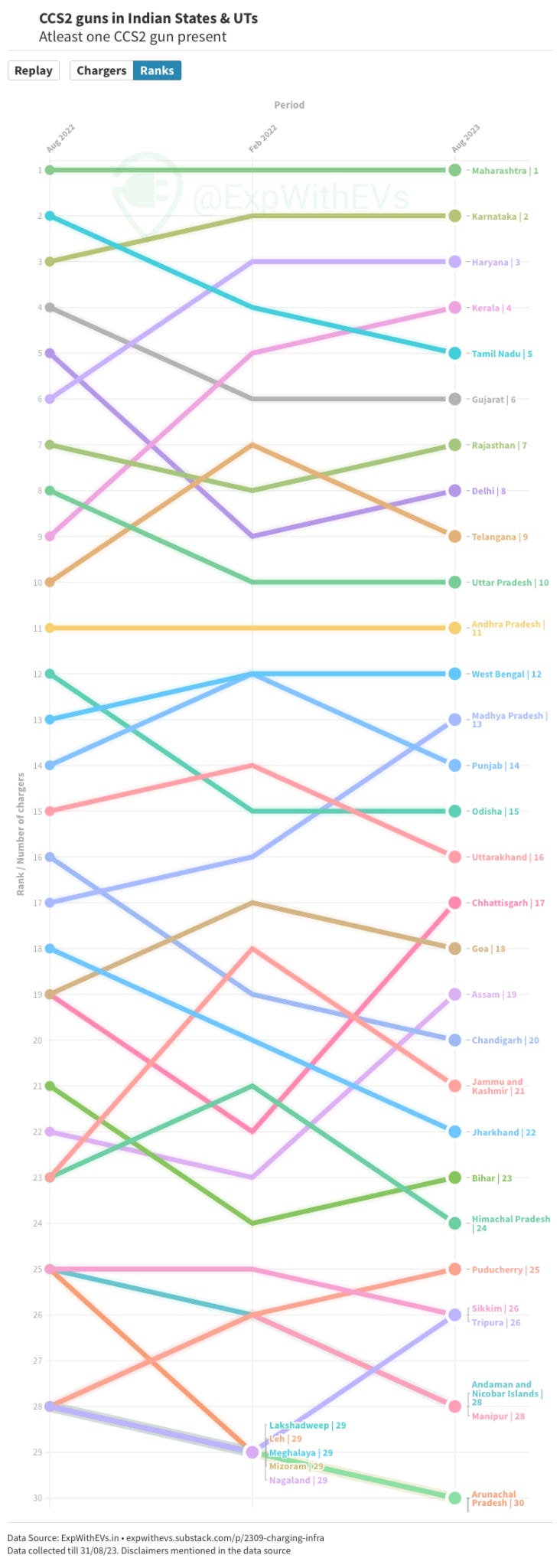

And here is the comparison over the year for CCS2 infrastructure.

The leaders are Maharashtra, followed by Karnataka, Haryana, Kerala and Tamil Nadu.

Kerala, Rajasthan and Delhi have improved their rankings, whereas Tamil Nadu and Telangana have fallen one place each.

Interactive running chart for Figure 4 is here. (You really want to check this link out). I also made a parliament seating representation for the state wise distribution of CCS2 guns. The interactive chart is available here.

Zonal Distribution

The South yet again leads the West for installed capacity of CCS2 guns, albeit with a shorter lead.

North-East and Central India have grown roughly 6X in a year. Helps when starting with a lower base. West and North have grown at 3.5X and South has grown at 4X.

East and Central India are lagging behind the West, North and South by over a year.

Interactive chart for Figure 5 is here.

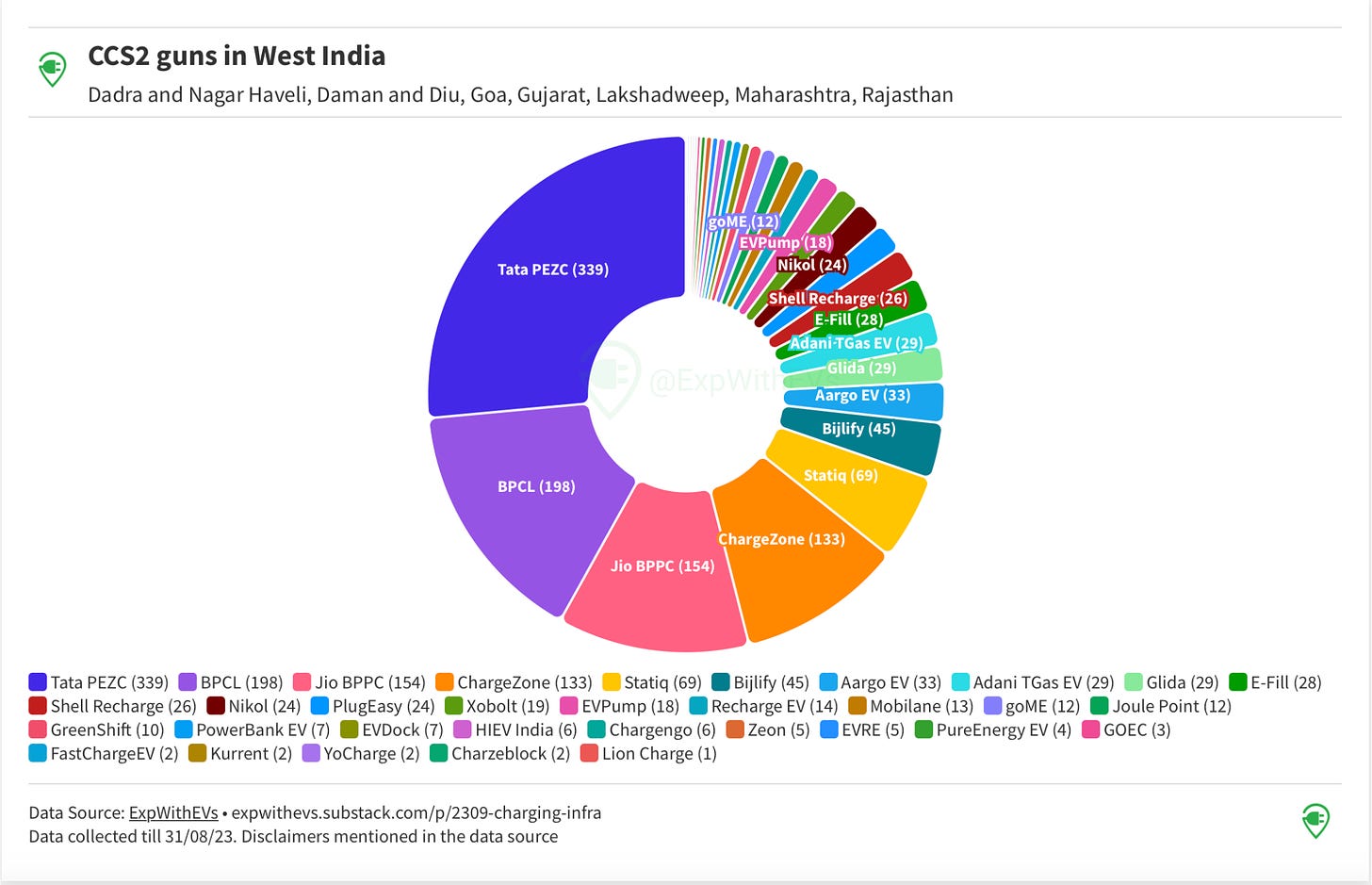

West Zone

Tata PEZC is still leading the charge. The share of Tata chargers has reduced from close to 45% to under 30%.

We have new contenders in second and third place - BPCL and Jio BPPC. ChargeZone and Statiq have been pushed to 4th and 5th place respectively. Jio BPPC has been growing aggressively and BPCL has run into problems.

Interactive chart for Figure 6 is here.

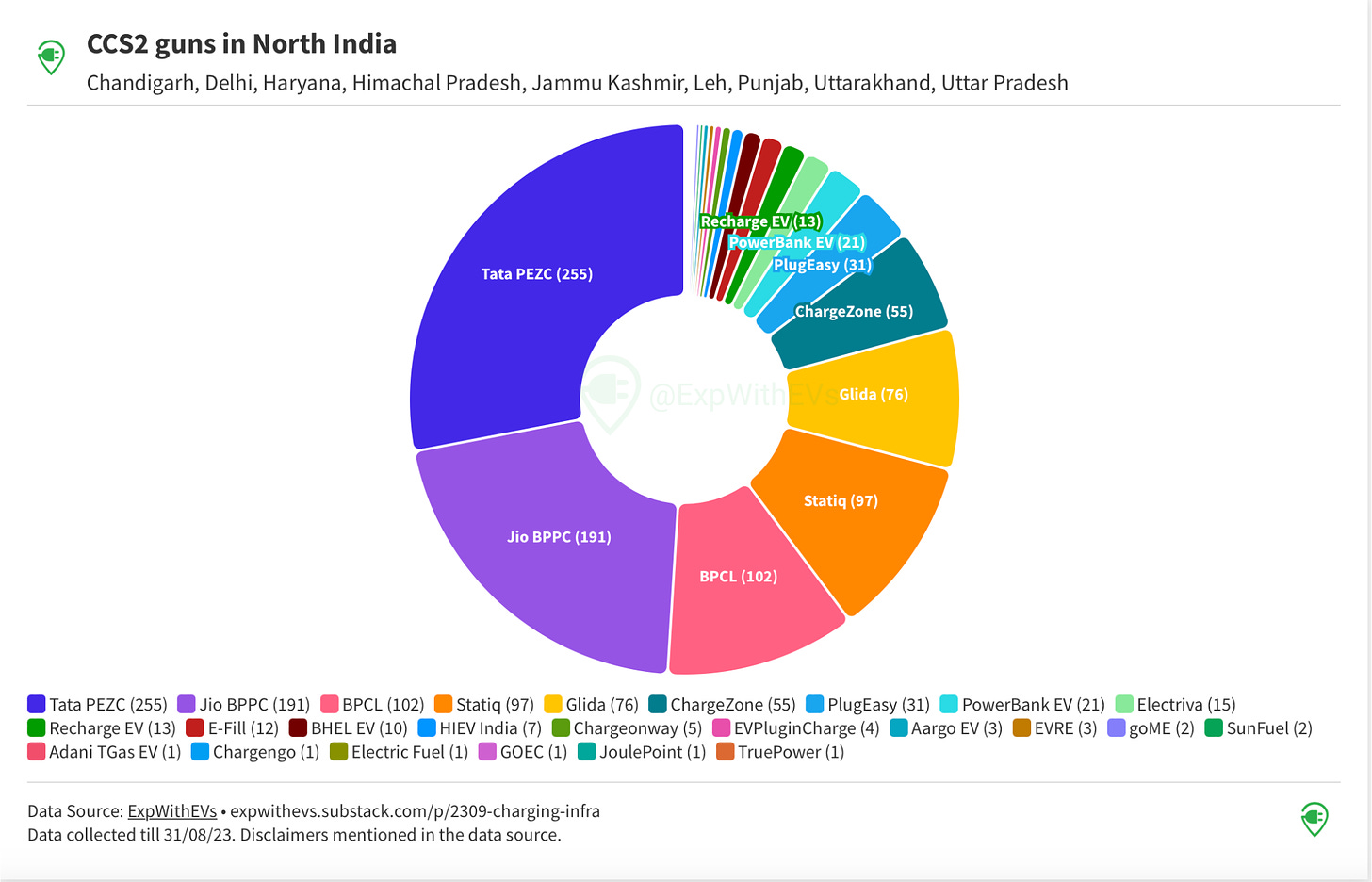

North Zone

Yet again, it is the same story as the West Zone. Tata is leading with a shrinking market share. BPCL and Jio BPPC have claimed the next two spots dethroning Statiq and Glida (erstwhile Fortum Charge and Drive).

Interactive graphic for Figure 7 is here.

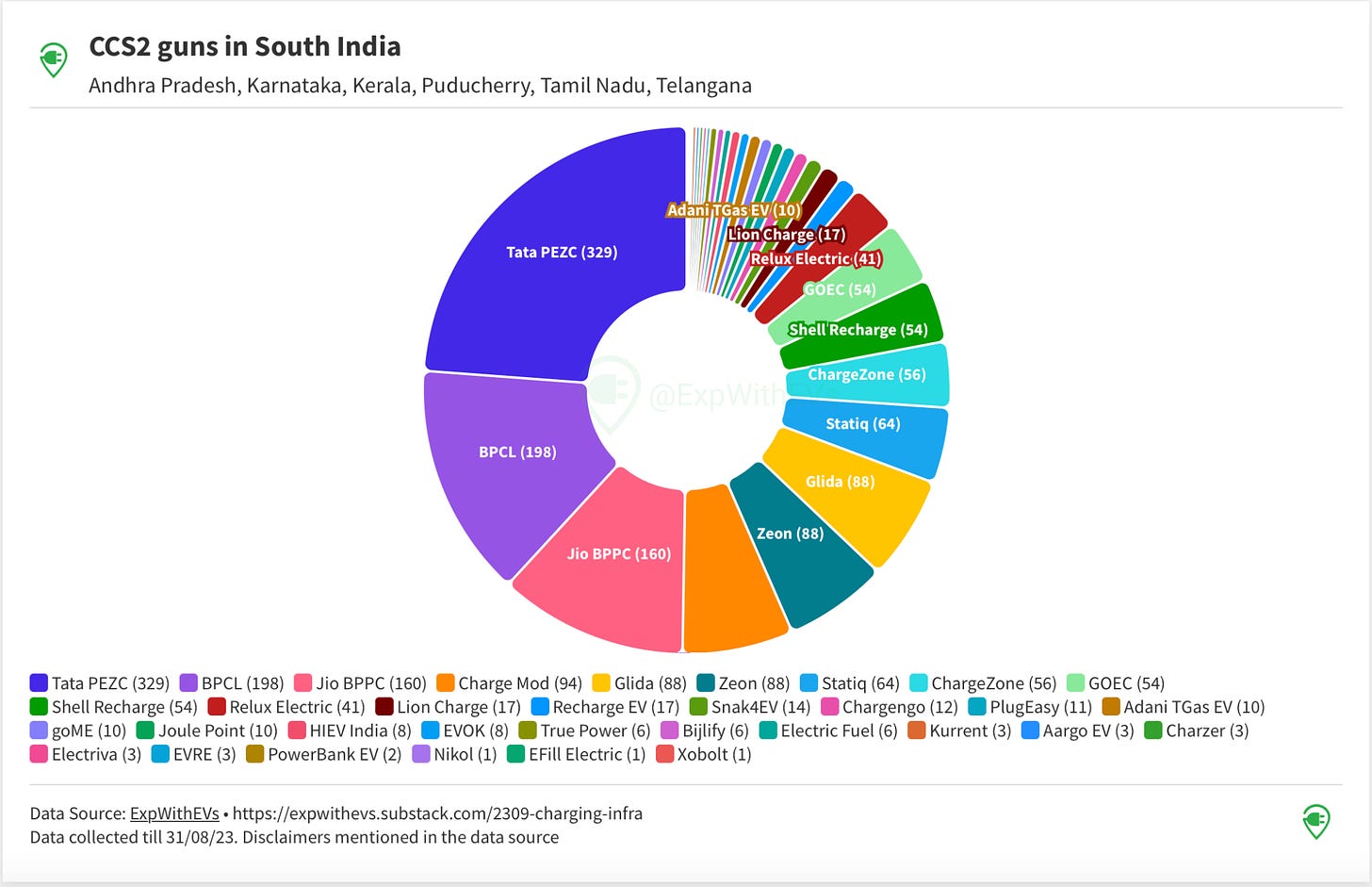

South Zone

Same story as both zones, with one major distinction. South has more medium sized players than North or West Zone.

Interactive chart for Fig 8 is here.

North Zone has 26 CPOs whereas the South and West Zones have 33 CPOs each.

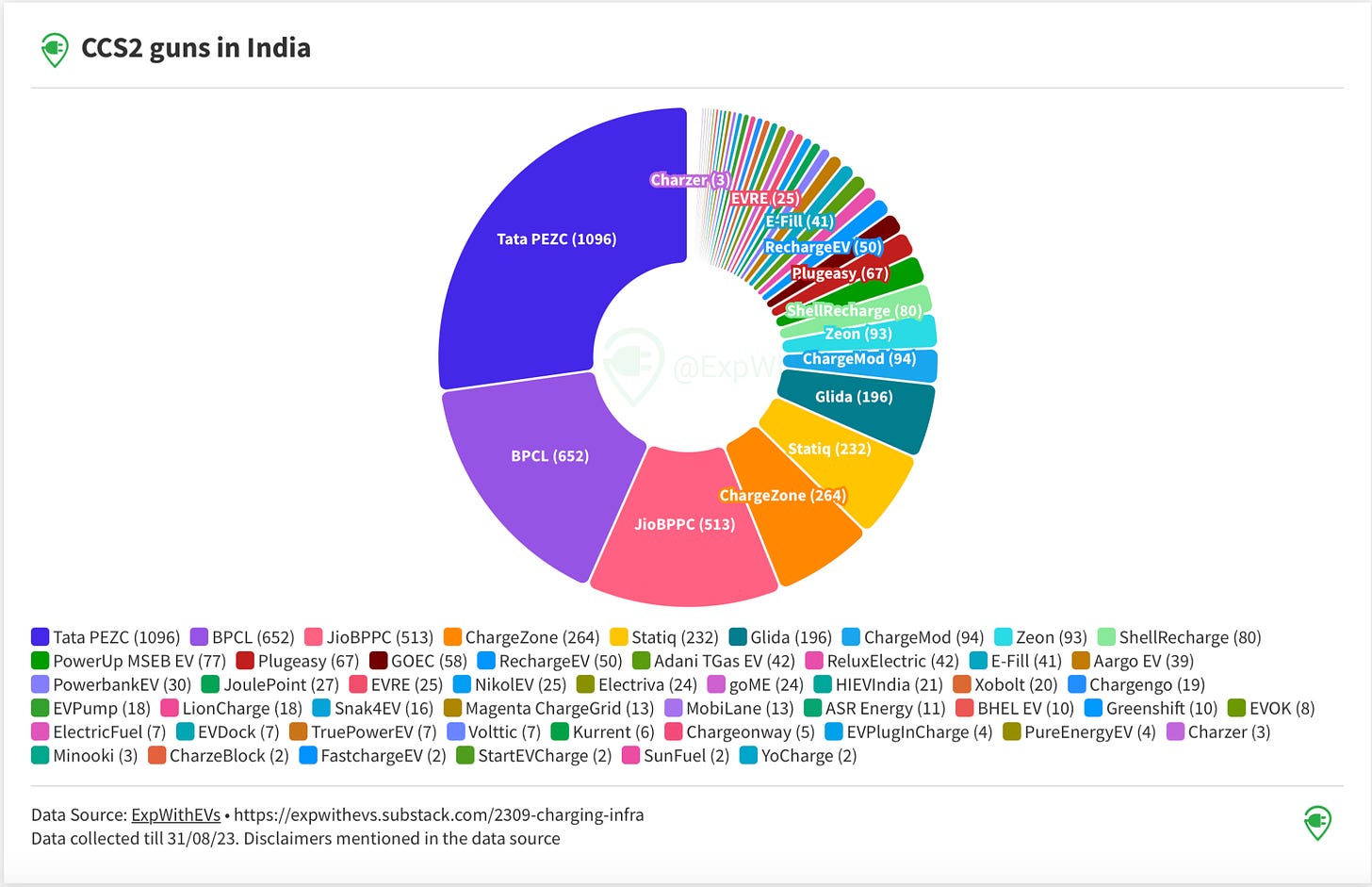

Pan India

Conclusion - There are 6 national CPOs namely - Tata PEZC, BPCL, Jio BPPC, ChargeZone, Statiq and Glida (erstwhile Fortum).

Zeon and ChargeMod are very strong regional players. The rest of them have to grow to catch up with the leaders of the pack.

Interactive chart for Fig 9 is here.

Offshoots of big businesses - Tata PEZC, BPCL, JioBPPC, Glida, Shell Recharge, Adani TGas EV, BHEL EV.

Startups that have raised $10M or more - ChargeZone, Statiq

This shows that it takes big money to be a national player in the charging space. If upcoming startups don't deploy the capital quickly, the bigger companies will become bigger, which might not always be the best for consumers.

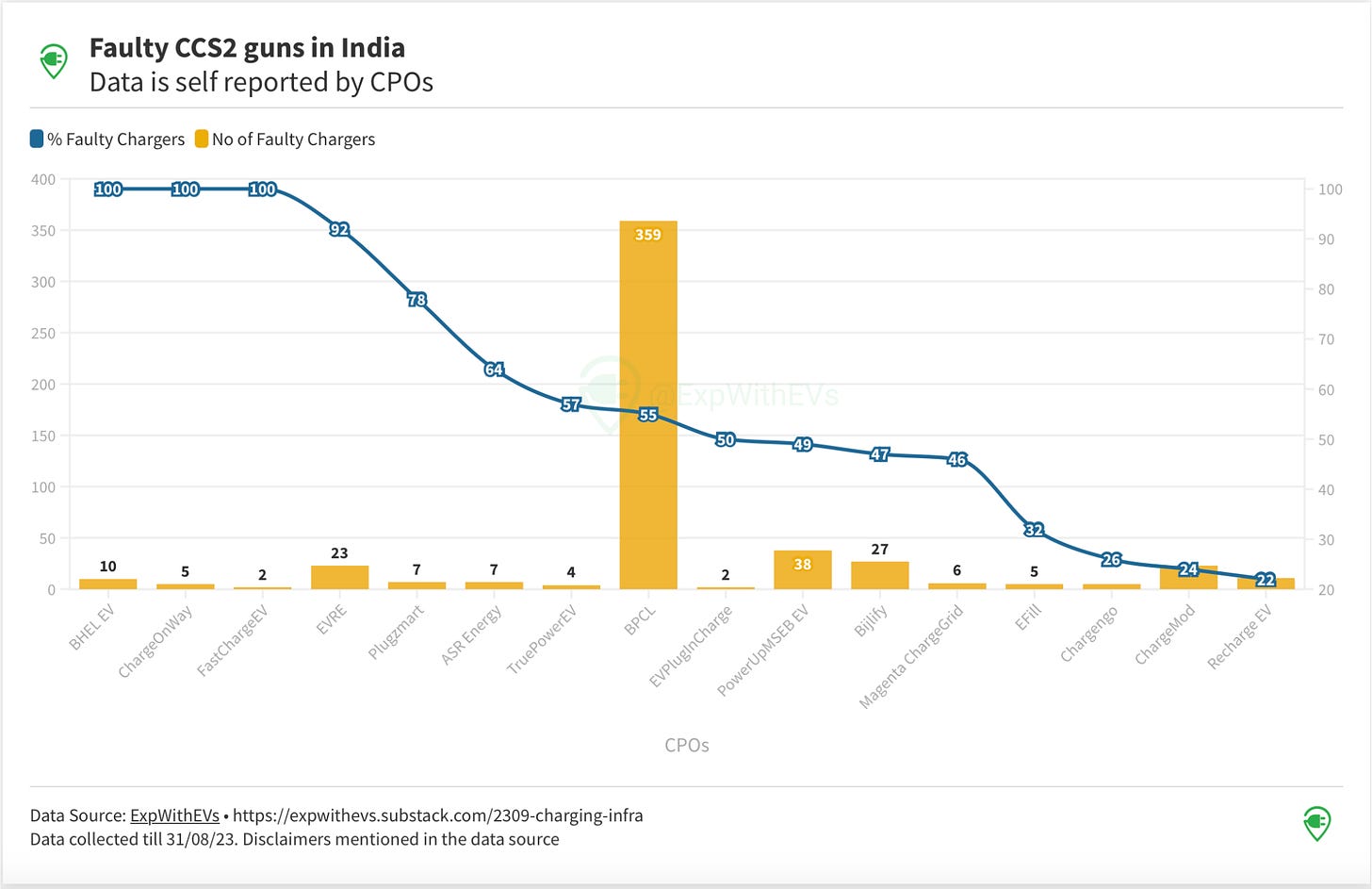

Faulty Chargers

These CPOs need to get their act together. They have a higher faulty charger percentage than the national average. I don’t understand what is going on in companies with more than 50% of their network being down.

Serious player with a higher percent of faulty chargers is BPCL. Rest of them are relatively small players.

Interactive chart for Fig 10 is here.

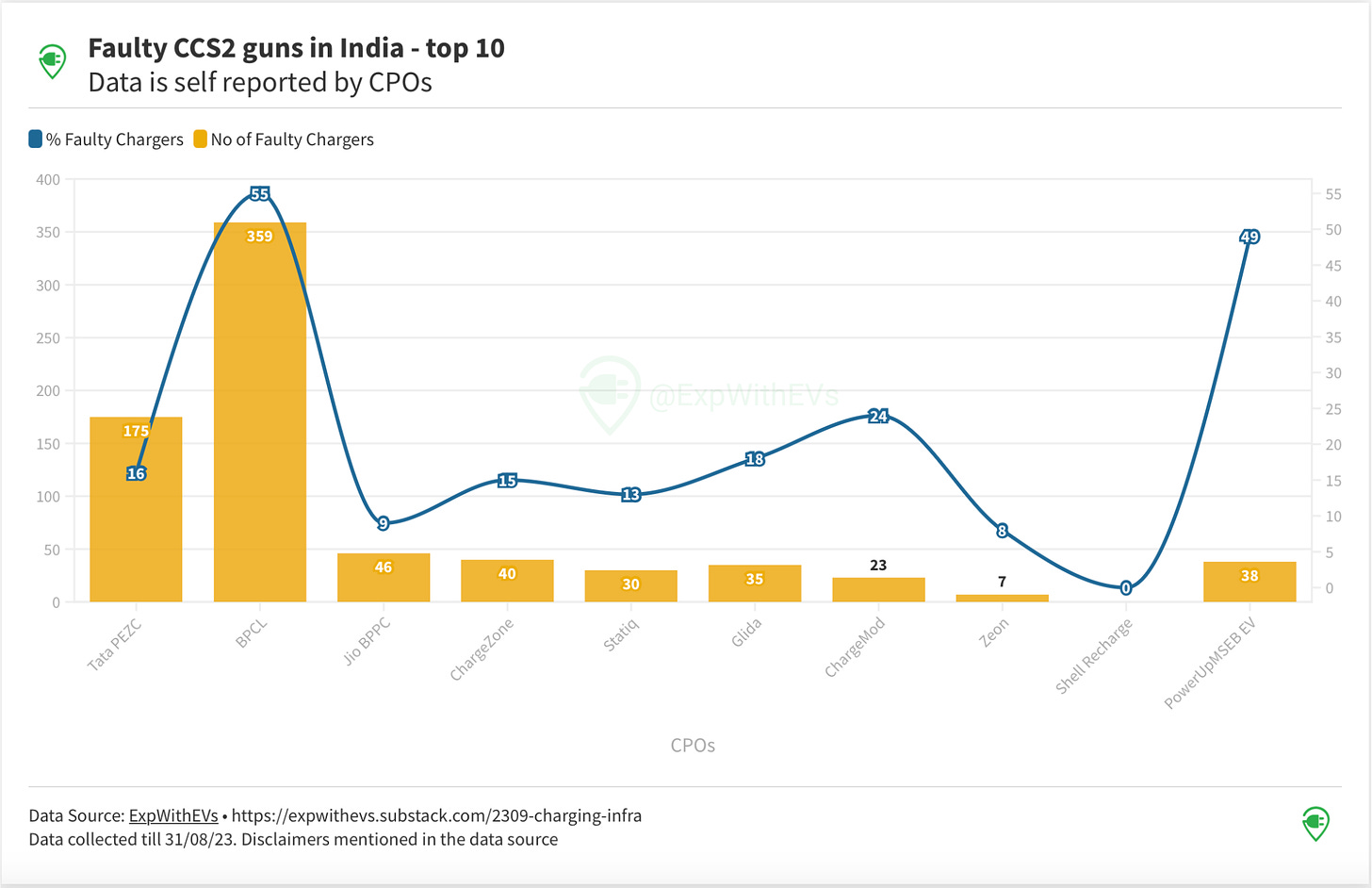

How do the top 10 players stack in this regard?

Cut the data in any shape or form and BPCL comes out with poor optics. Top 2 non performers BPCL and PowerUpMSEB EV are both PSUs.

Tata PEZC should also work to reduce the number of faulty chargers. Kudos to Shell Recharge on bringing their fault percentage from 60 to 0 in six months.

There are some CPOs, like BPCL, who prefer to put up a charger on their app before the network is operational and some, like Xobolt or Zeon, make the charger online only after the charger is fully operational.

Interactive chart for Fig 11 is here.

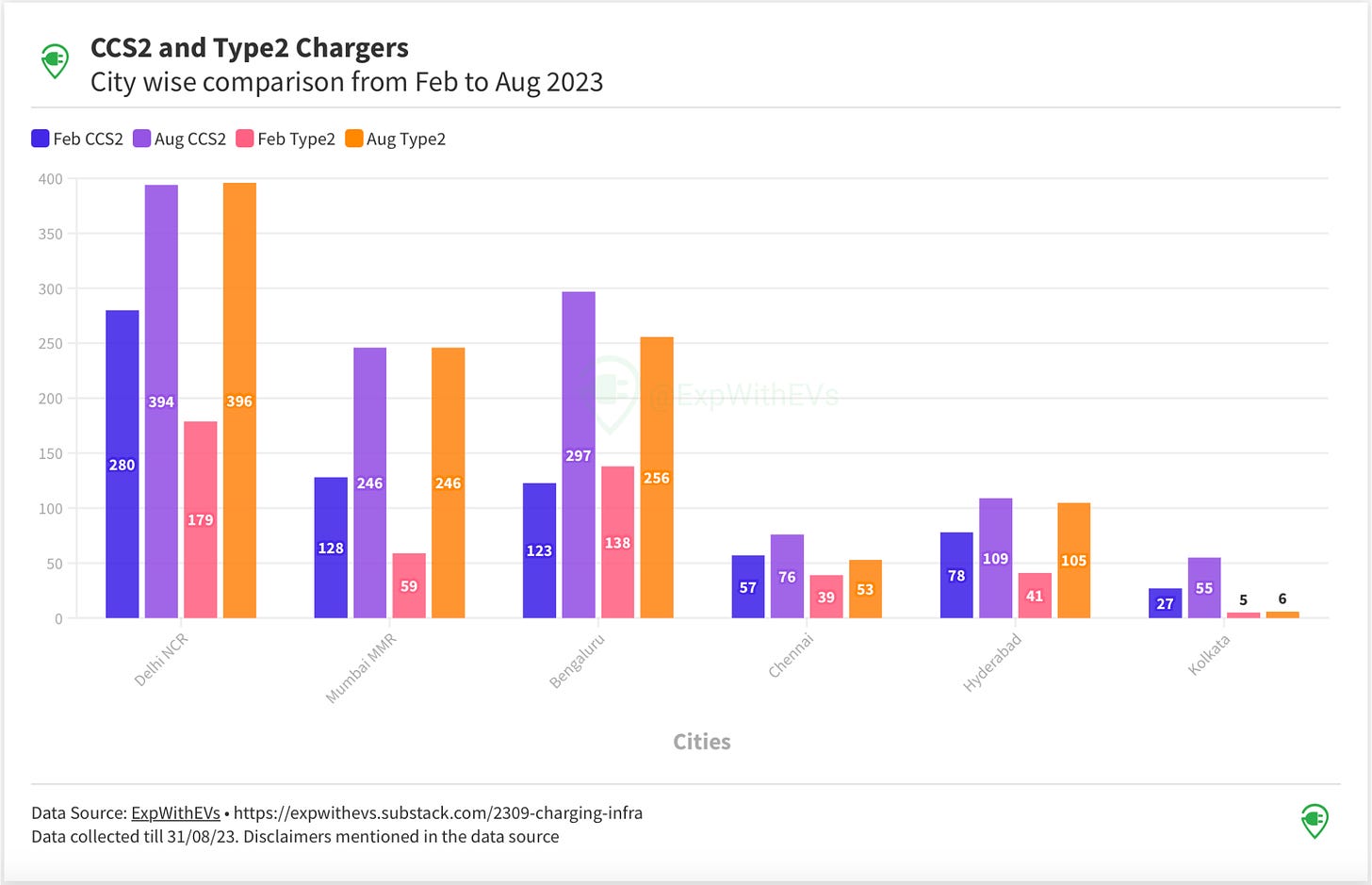

Metro Cities

The charging infrastructure has grown tremendously in the 6 major metropolitan cities. Bengaluru has pipped Mumbai MMR to take the second spot, while Delhi NCR region continues to maintain a solid lead.

Interactive chart for Fig 12 is here.

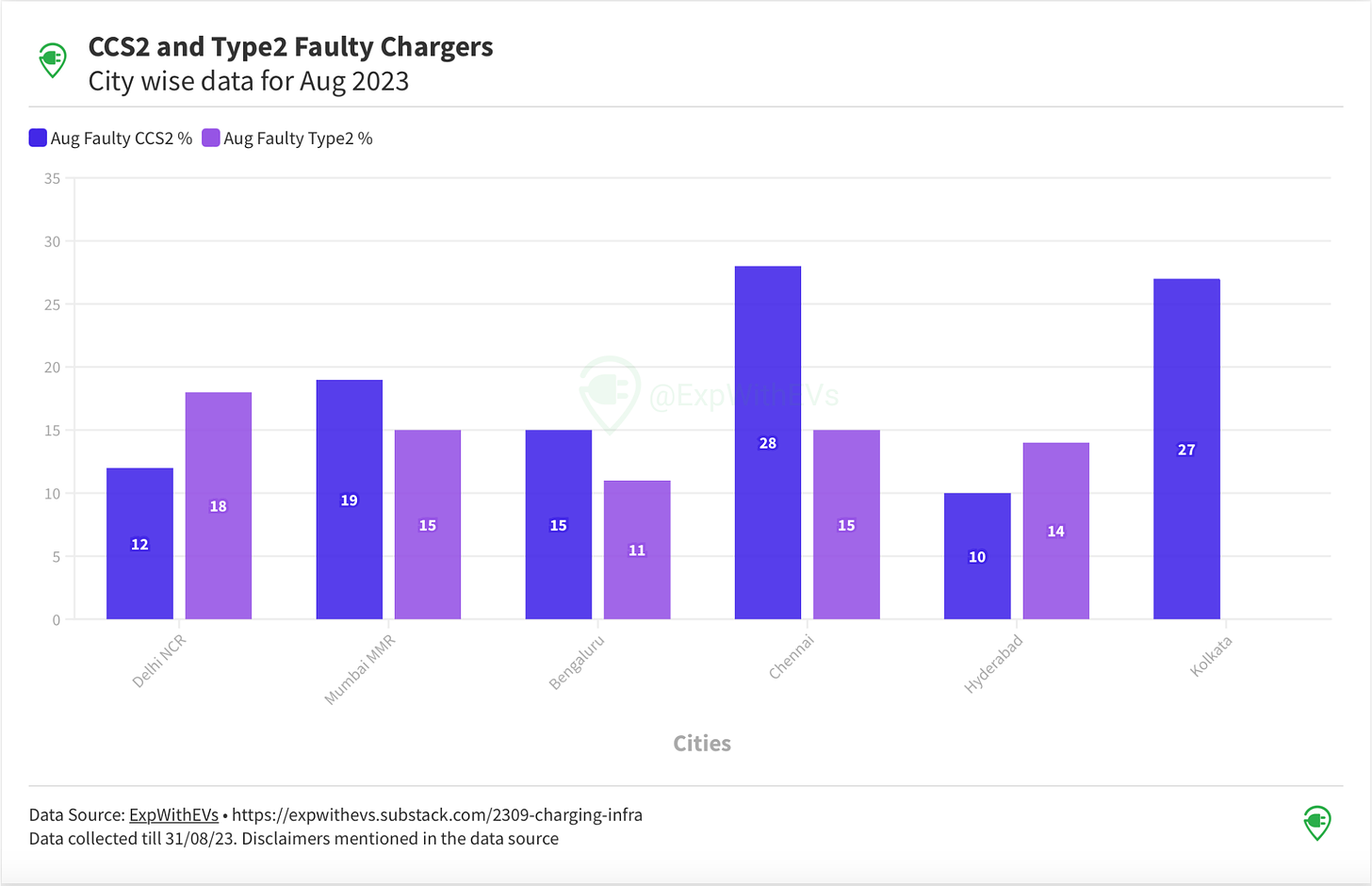

Chennai and Kolkata have higher faulty CCS2 chargers than the national average. It is easy to get approvals for higher load capacities in cities, thus explaining the lower than usual CCS2 and Type2 faulty chargers.

Interactive chart for Fig 13 is here.

Type2

As mentioned earlier, in my Feb 2023 report, I had considered Tata PEZC’s restricted chargers too. This is now corrected in the current report.

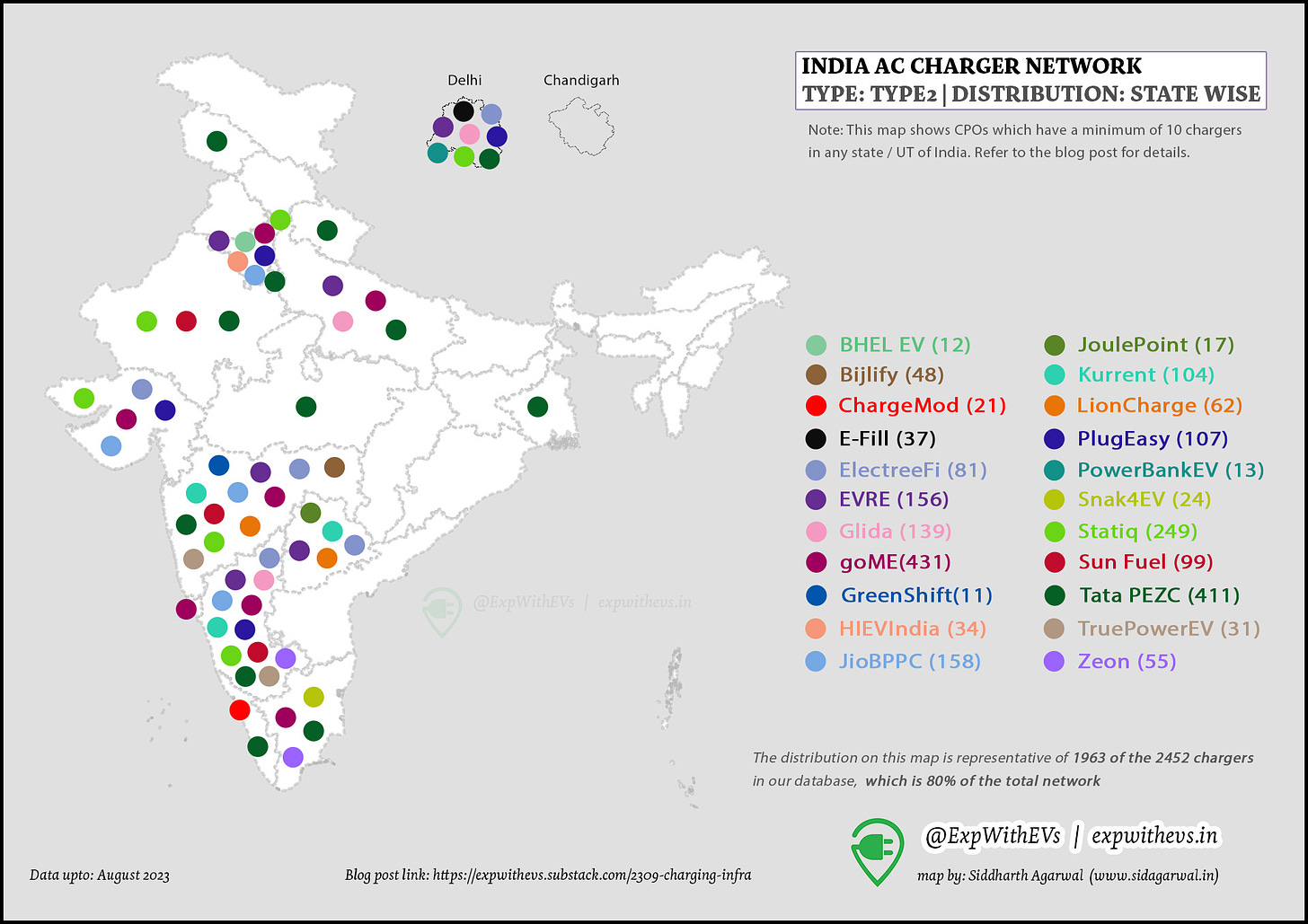

There are atleast 22 CPOs having more than 10 Type2 chargers in a state / union territory. This number was 13 earlier. This shows that more CPOs are aggressive in expanding their Type2 infrastructure.

This gif shows the growth of the infra

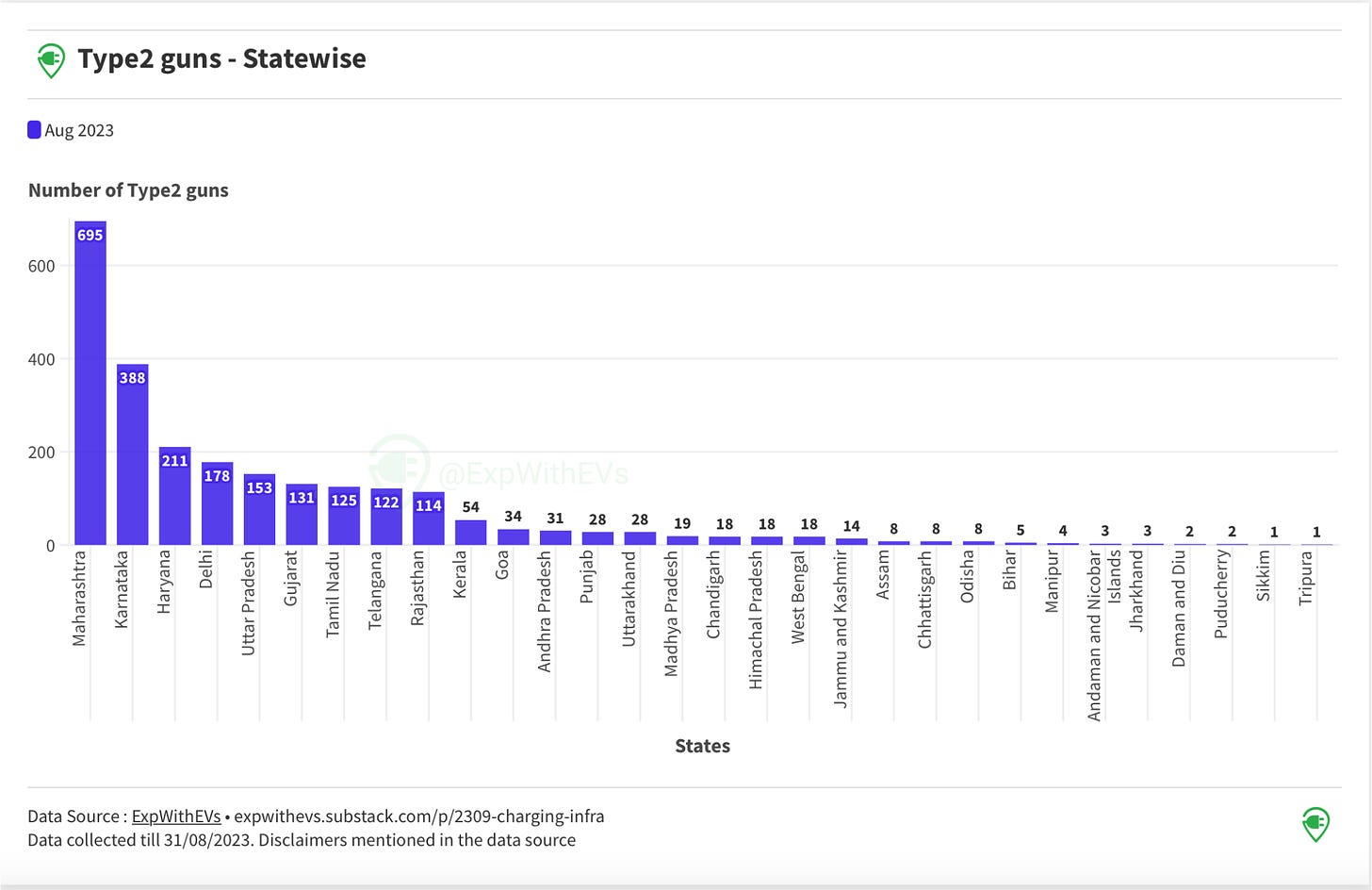

Maharashtra is the clear leader when comparing absolute numbers. Uttar Pradesh, Gujarat, Tamil Nadu, Telangana and Rajasthan are competing for the 5th spot. This is a good sign.

The total number of Type2 chargers is 2452, which is a 1.36x increase in 6 months from 1802.

Interactive chart for Fig 16 is here.

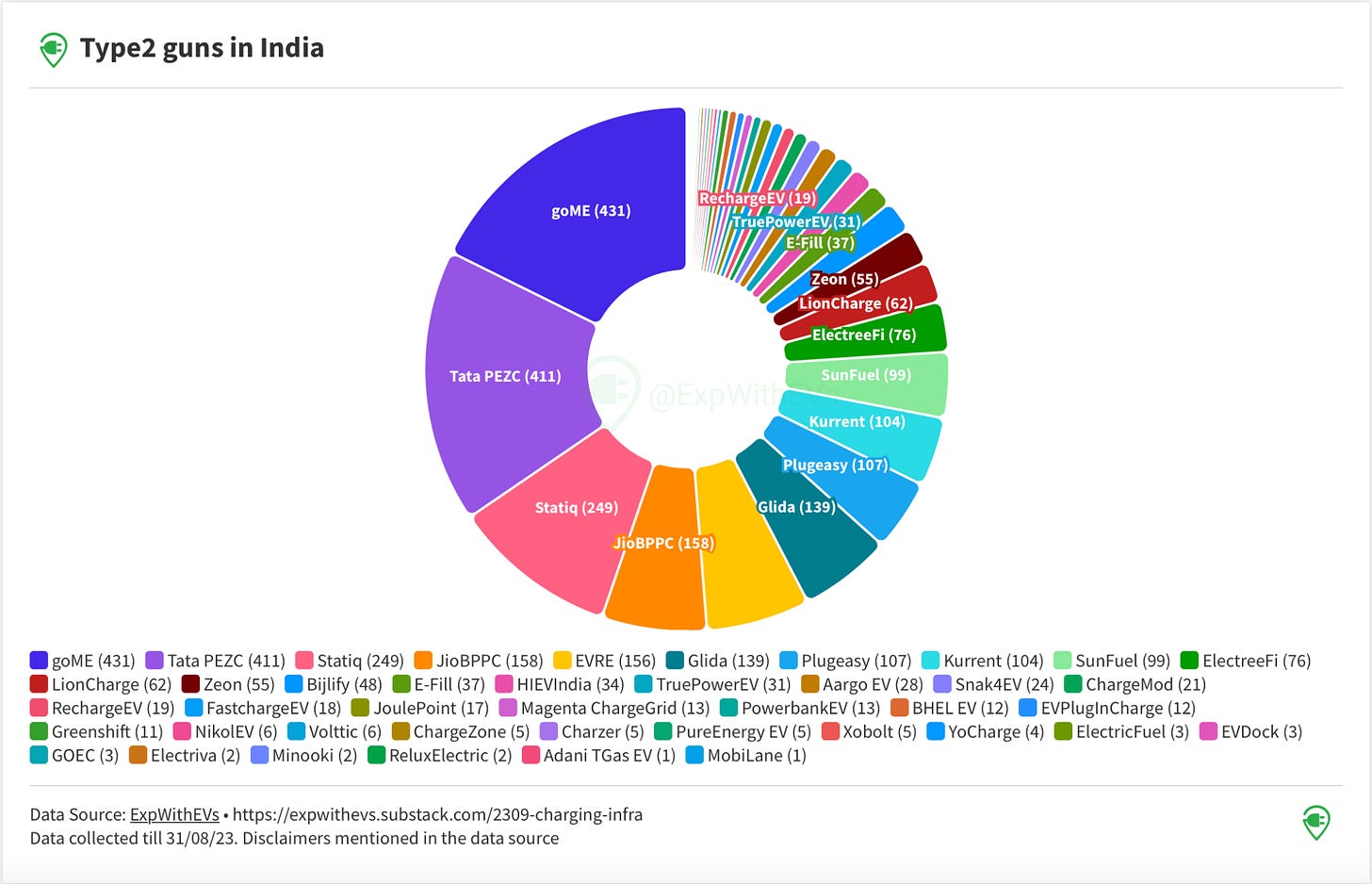

Marginally leading CPO here is goME, followed closely by Tata PEZC. Fun fact - goME is responsible for close to 35% of Type2 chargers in Maharashtra. We finally have a competitor to Tata. However, goME is present only in 14 states, whereas Tata PEZC is present in 26 states.

Interactive chart for Fig 17 is here.

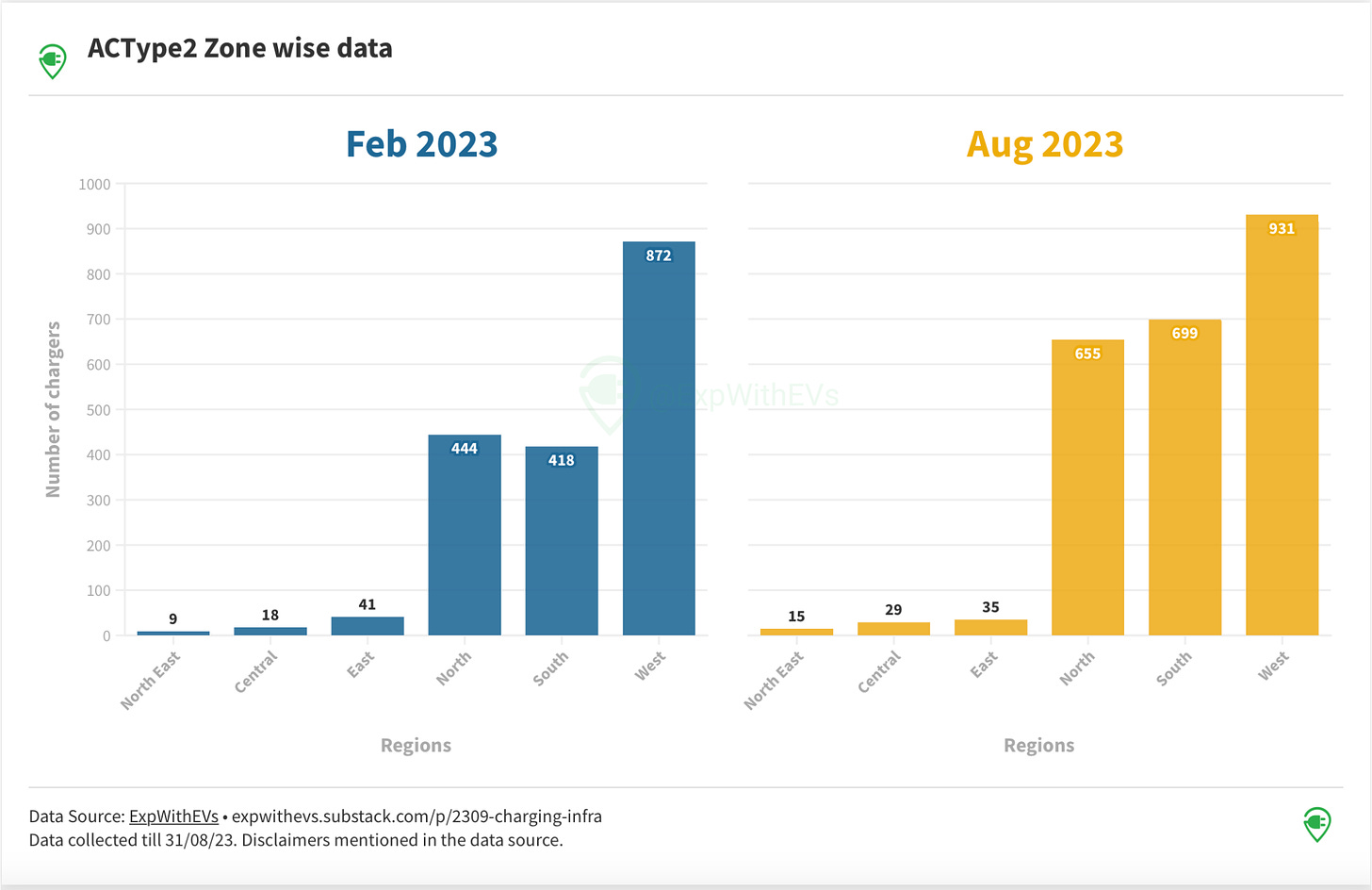

Type2 Zonal

The growth in North and South zones has been promising. The growth in other zones have been disappointing.

Interactive chart for Fig 18 is here.

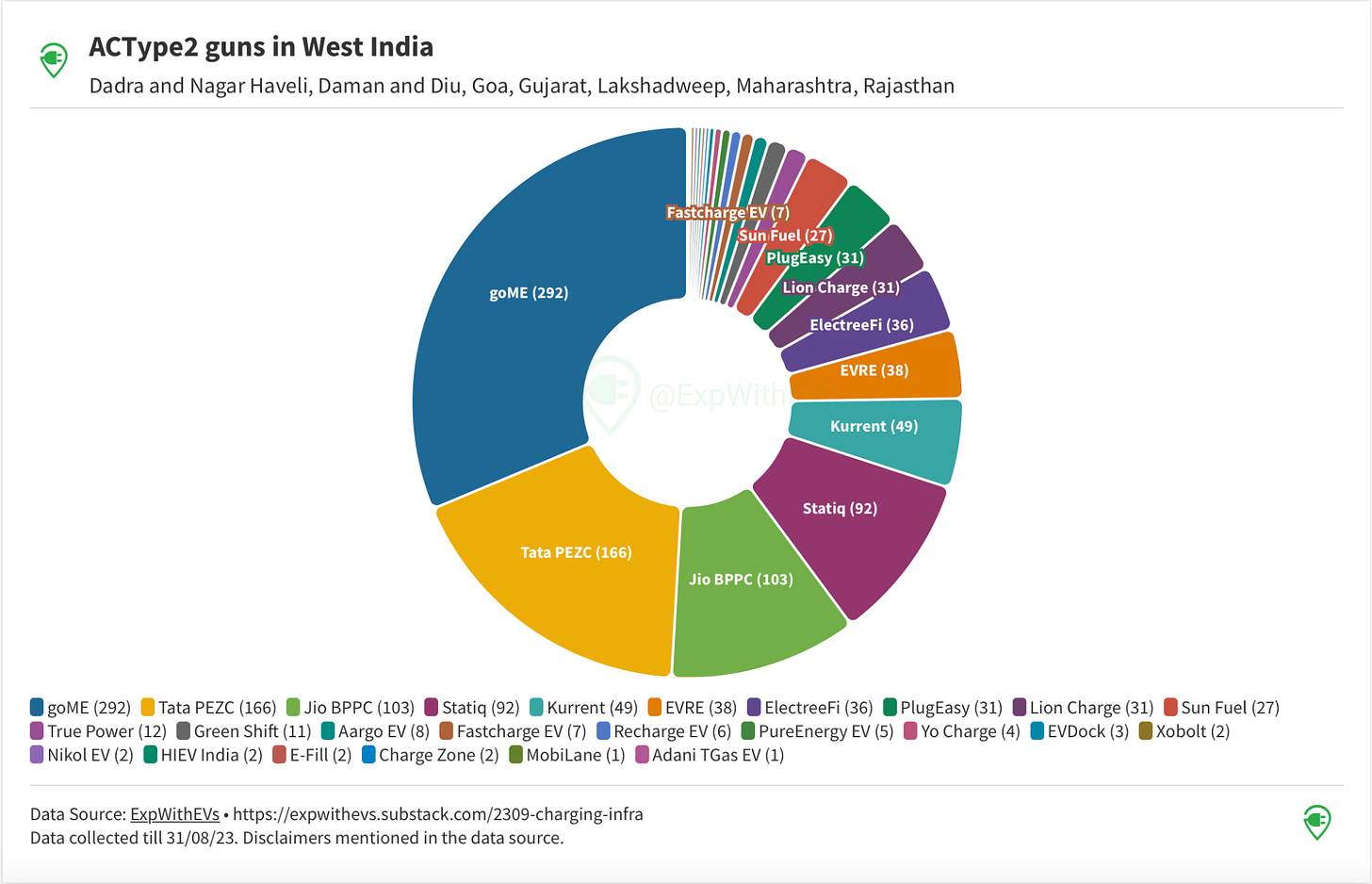

West Zone has a clear leader in goME. Tata PEZC has a comfortable 2nd position. Jio BPPC and Statiq are vying for the 3rd spot.

Interactive chart for Fig 19 is here.

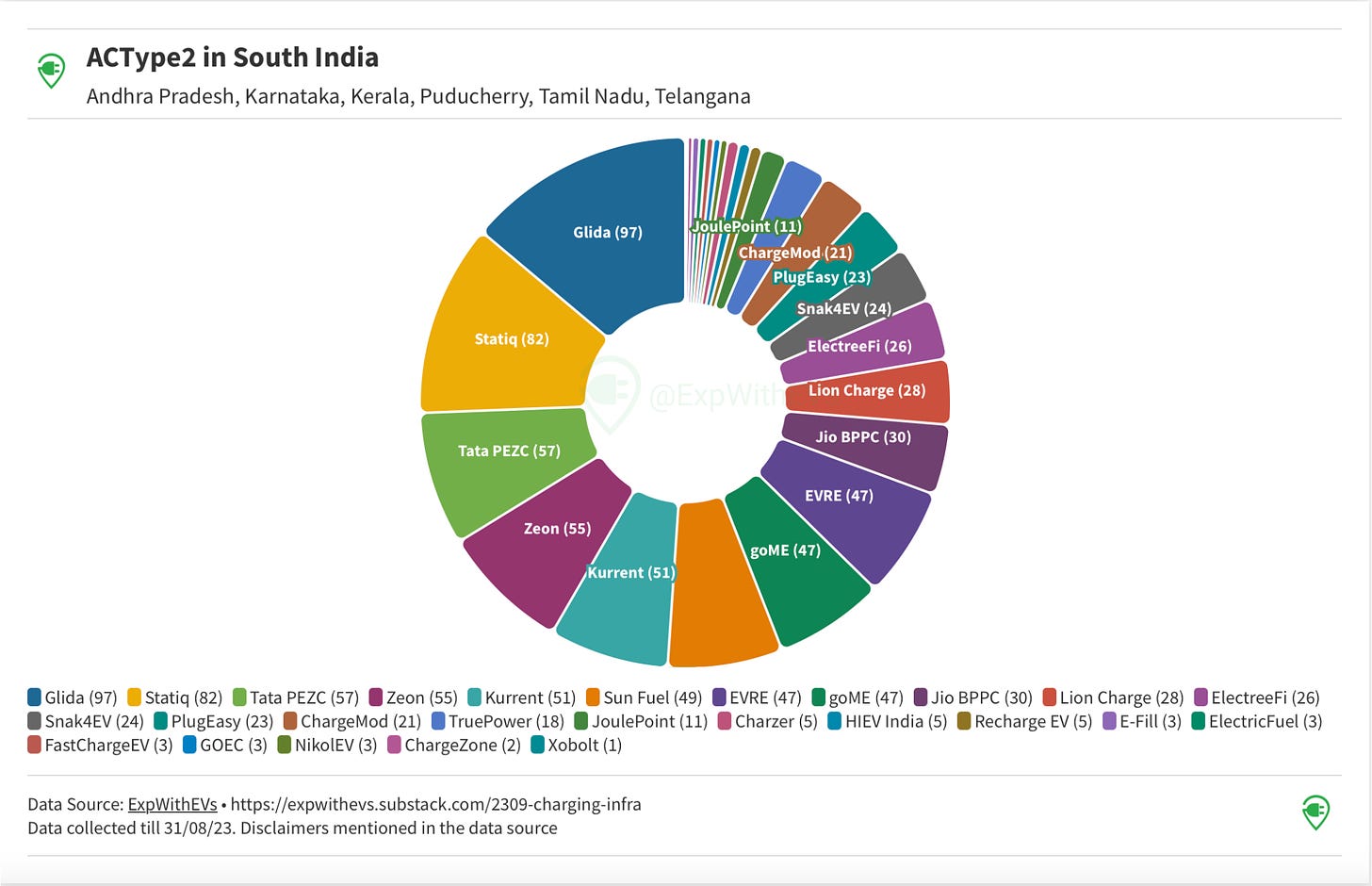

South Zone has a new leader in Glida (erstwhile Fortum). Statiq is in striking distance to take the leadership away from Glida. Tata PEZC, Zeon, Kurrent, Sun Fuel, goME and EVRE are in close competition for the third spot.

Interactive chart for Fig 20 is here.

Tata PEZC is still leading in the North Zone. goME is in the second spot. Statiq and EVRE are tied in the third spot.

Interactive chart for Fig 21 is here.

North and West Zones have 25 CPOs with a minimum of one Type2 charging gun and the South Zone has one more CPO, i.e. 26 CPOs.

Real world costs of fast and slow charging

Please note, this includes the slow charging at malls, resorts, hotels, friends’ houses with little to no cost.

This real world data has been collected since May 2022 and shows that home charging is the most economical option. Also shows that despite road trips of ~20,000 km, home and slow charging units are more than 2x the fast charging units.

Total running costs of driving two EVs cumulatively 42,000 kms is approximately INR 1.77/km with an efficiency of 149 wh/km or 6.7 km/kWh.

Interactive chart for Fig 22 is here.

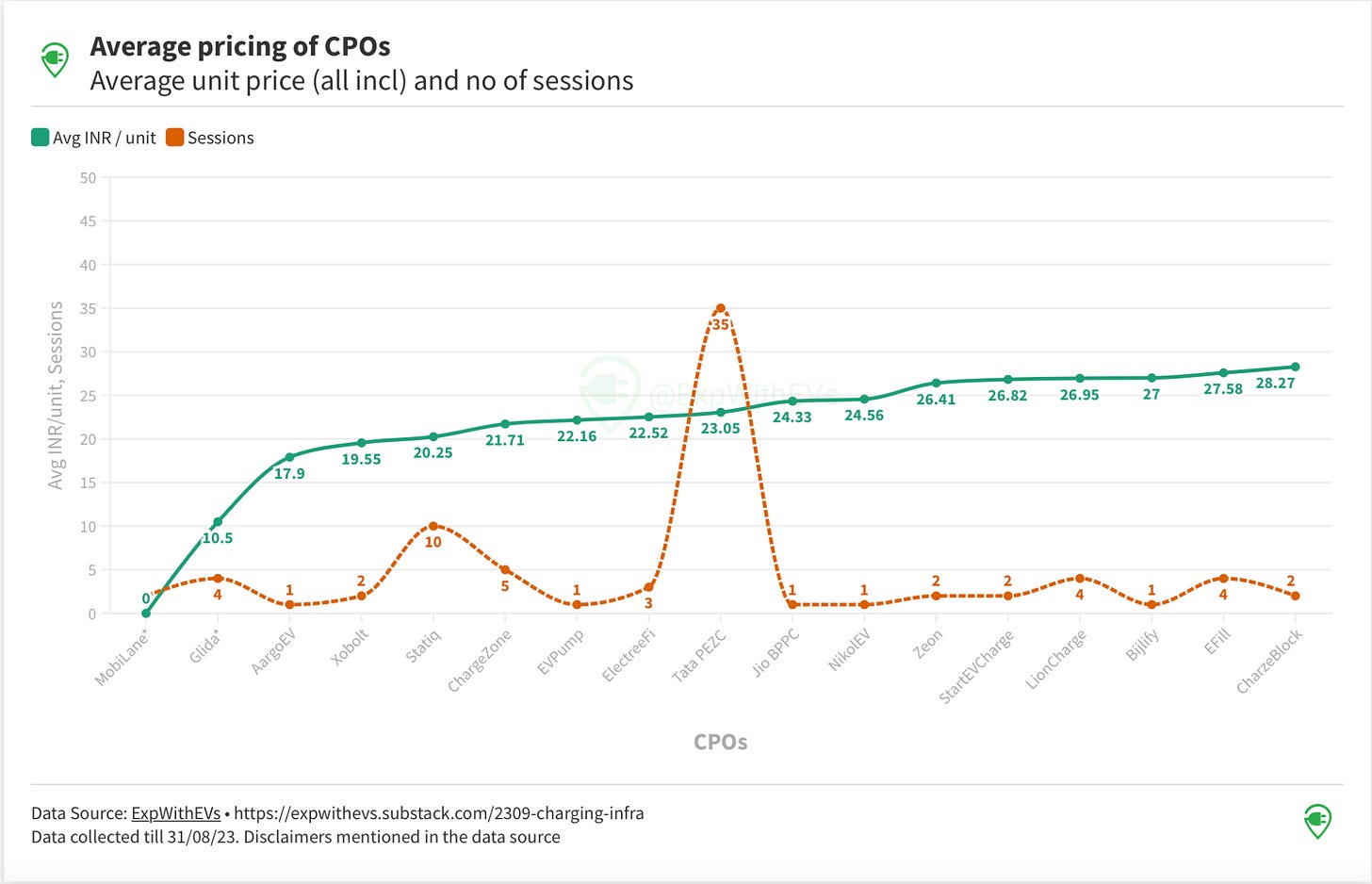

CPO charging costs

I’ve used around 18 CPOs to fast charge my car. I prefer trying out new CPOs, so a regular Joe may not try and use these many CPOs.

Data from Glida and MobiLane was taken during the offer period, which reflects low average pricing.

Interactive chart for Fig 23 is here.

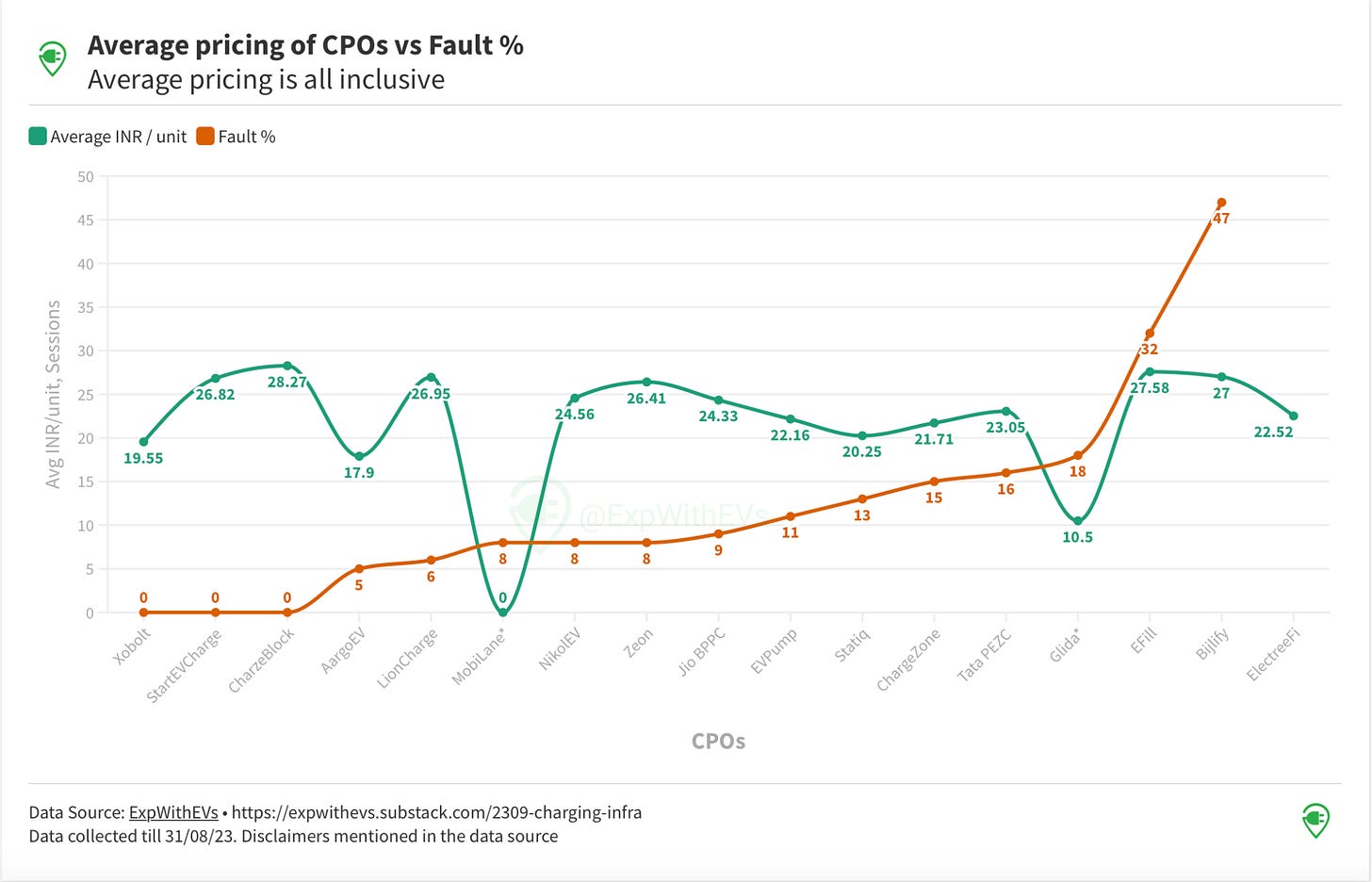

Lower fault percentage means the CPO is more reliable. My threshold would be under 20%.

Data from Glida and MobiLane was taken during the offer period, which reflects low average pricing. Unfortunately, reliability numbers for ElectreeFi aren’t available.

Interactive chart for Fig 24 is here.

Cheaper CPOs are better for consumers. Average price / unit is around INR 25. Thus, from my experience, the better CPOs in terms of pricing and reliability are - Xobolt, AargoEV, NikolEV, JioBPPC, EVPump, Statiq, ChargeZone and Tata PEZC.

Also, kindly note, Fault % is also a function of the number of chargers by a CPO. For example, StartEVCharge and CharzeBlock have only 2 fast chargers each. It is easier to maintain them vs any CPO with more than 20 chargers. Refer to Figure 9 for the numbers for each CPO.

You can also deep dive into each charging session and the details on these two google sheets. Data includes how much time was spent at the charging location, how many units were consumed and the money spent per CPO.

Conclusion

The charging infrastructure is growing at a rapid pace. The reliability of the infrastructure will also increase once some major players improve the working / not working ratio. Anecdotal experience - I could not think of doing the Mumbai Delhi route via MP 6 months ago, but I ended up doing it in September 2023.

I’m going to restack my older wishlist from CPOs here. A few of the CPOs have already started working on these points, but I hope more take notice and work on it.

Must have and slightly difficult to implement - Booking a slot :

Many CPOs already provide for booking slots as an option. However, some or the other features are missing in all apps. Here is how I’d like to see it get implemented.

While it is a great feature to have, users may have a tendency to book a slot and not show up or may genuinely not be able to make it. To avoid abuse, CPOs should block a minimum amount from their wallet to book a slot. Once the user reaches the charging spot +/- 20 mins for the time they’ve booked, the blocked money should be used for the charging session.

Let’s say Mr X has booked a charging slot at Tata PEZC for 1600h. Mr. A arrives at the same charger by 1520h. Mr. A should be allowed to initiate the session. He should also be shown a warning that the charger is booked from 1600h and the session will automatically end when Mr X shows up. The CPOs already have location permission within their apps. So, when Mr X reaches the charger, there should be an option on the app to “activate” the booked charging session. This will end Mr. A’s session and the charging gun will be unlocked for Mr X to use. Obviously if Mr. A is not around and the charging gun isn’t released, then the CPO should reach out to Mr. A and update them about the session. This allows for maximum utilization of the charger.

Incase Mr X doesn’t show up (within specified time limits) for the booked slot, then the booking amount should be deducted from their wallet. There should also be an option for Mr X to cancel the booking because there are too many variables which can cause delays to reach a particular charger.

Must have and easy to implement - Charger Status:

Most apps today only have a feature showing that the charger is Busy / Unavailable / Available. CPOs should add a “Finishing” status on the app. ChargeZone and some other CPOs do it. However, everyone else can easily adopt this feature. Allows users to plan better.

Along with “finishing” status, some CPOs are also showing “last active” and “last used” data points. This is extremely critical for users. Reliability of the charger can also be predicted based on these data points.

Many small CPOs don’t necessarily have a software team to build and maintain the app. Often this work is outsourced to a third party. Most times, these third parties also provide the CPO with OCPP / OCPI protocol. This is an open protocol allowing communication between the charger hardware and the CPO’s backend. They also provide the CPO with an app. That is why many of the apps have the exact user interface, except the color scheme. These third-parties should integrate and push these features for all the apps they are servicing. I’m looking at you, Numocity!

Must have and difficult to implement - Non Wallet integration:

In my previous post I’ve already spoken about getting rid of wallets. Without wallets, CPOs have two ways to collect payments. The first one is Postpaid, i.e. payment collection after the charging is done or secondly, via blocking a mandate on the user’s card / UPI.

Fortum used to have a postpaid method of collecting payments. On my podcast with Fortum Charge and Drive India’s head - Mr. Awadhesh Jha, he mentioned that Fortum had high receivables. The users are expected to clear their payment after the charging is done. However, many users would simply create new accounts or clear the payment only when they had their next charging session. Thus, trusting the consumer to pony up hasn’t made business sense in India. The postpaid method of payment however is a standard practice in Europe and USA.

According to me, money being blocked on UPI via a mandate makes the most sense in India. Granted, many EV consumers would most likely have a credit or a debit card, but UPI is widely used. Or another option is to deposit INR 1000 (or whatever is the average amount of that user per session, or the maximum amount based on the battery capacity of that vehicle) with a payment gateway like RazorPay. Once the session is done, the payment gateway can refund the balance amount via the same UPI id, or can issue a demand for the balance.

Good to have and difficult to implement - AutoCharge / Plug n Charge:

Some CPOs are already working on this feature. Once the car is connected to the charger, the CPO should be able to identify the user and initiate charging based on the money in the wallet or via pre-authorized mandates. This makes the whole experience a lot smoother for the consumer. From my discussions with CPOs and Charger OEMs, except Tata cars, this feature is possible in almost every other Auto OEM. With some polished software, we can expect this to be rolled out real soon for most CPOs.

As far as Tata is concerned, they have the highest number of cars on the road and the highest number of chargers. It really depends on them when they would want to flip the switch and enable this feature.

Must have and easy to implement - Error codes:

If you have charged your EV enough times, you must’ve received a charging error at least once. If not, you should consider yourself lucky and maybe even buy a lottery ticket?! Presently, if there’s any error during a charging session, then the charger display shows an error code. Oftentimes, you have to look up the error code online in hopes that there’s an explainer somewhere, or ask within the community. Trust me, I had to do it. Not everyone is equipped to do this. It would be great if the CPO can send a notification on the app itself clearly stating what the error means.

The notification should also include whether the issue is fixable by the driver (say the charger just needs a restart) or if it needs intervention by a professional. In case of the latter, obviously the company appointed professional should be notified immediately by the CPO and the user can talk to them if needed. If the power to the charger is cut off by the local electricity board, then the notification should say so. That way, the consumer knows that the CPO isn’t to blame but the local electricity board.

Good to have and slightly difficult to implement - CarPlay / Android Auto :

Many consumers use CarPlay / Android Auto. They are often looking for a charger while driving. Makes total sense to have a CarPlay or Android Auto support. None of the CPOs currently provide this.

Must have and easy to implement - Rooftops at the chargers:

I can’t believe that I have to say this, but there needs to be a roof on top of the charger as well as the parking space for the car. This protects the charger as well as the car & car owner from continuous static exposure to the sun and torrential rains. Seriously guys, please put up a roof.

Must have and easy to implement - Dedicated parking for EVs at the chargers

PAINT THE PARKING SPOT! I’ve seen countless instances of charging stations being blocked by ICE cars. ICE cars may have parked it there without seeing / knowing that there is a charger present.

Only certain kinds of people would park in a reserved spot not meant for them. Nothing can be done about them. With the painting and appropriate signage around, most of the drivers would happily comply.

Must have and easy to implement - Reliable phone support

It is imperative to provide reliable phone support by CPOs to their customers. We have high number of non working chargers. Having a reliable support centre can help resolve many queries for the consumers.

I reached out to every CPO via their app. I got a No response / Switched off / No phone number for 22 out of 48 apps. This is just terrible. Data has been collated in my sheet here.

This piece can be re-published (CC BY-NC-SA) with a line mentioning ‘This was originally published on ExpWithEVs.in’ and a link back to this page. In case of re-publishing, please alert priyansevs@gmail.com

Text, charts and analysis - Priyans Murarka

Data collection - Lucky Agarwal

Maps and gifs - Siddharth Agarwal