Feb 2023 India EV Charging Infra

50+ India based CPOs, CCS2 & Type2, faulty chargers, interactive graphs, analysis, wishlist and some unfiltered comments. Dig in!

Edit : April 2025 : If you are looking for the latest edition of EV Charging Infrastructure Reports, then please follow these links :

2503 EV charging infrastructure

In my last post I reviewed and presented the data for around 14 Charge Point Operator (CPO) companies in India. Based on the community’s response and my discovery of new CPO players in the market, I am reviewing 50+ charging apps in this post.

This post has a lot of data and inferences drawn by me. If you’d like to skip directly to the data, here’s the link to many google sheets.

Who am I to review these companies? I have an experience of driving over 25,000 kms in my EV in road trips across the country and have communicated pain points of EV consumers via my interactions with CPOs.

Updates from my Tiago experience :

I’ve been enjoying the experience of driving the TiagoEV in Mumbai as my daily driver. Here’s a twitter thread documenting my experience of getting a highly efficient range of 250 kms in Mumbai traffic!

Let’s go!

The focus of my last post was just CCS2 guns. Since then, I have experienced the pain of finding a reliable Type2 7.4kW charging gun on road trips. So this time around I’ve also included Type2 chargers in my analysis.

The analysis doesn’t cover 3.3kW charging or DC001 charging. It is possible to get 3.3kW charging via a 15A socket which is available everywhere. DC001 is more relevant for B2B consumers and usually their charging networks and vehicles aren’t open to the public.

Here’s a quick Explain Like I’m 5 - ELI5 refresher for someone who is new to these terms.

CCS2 - Common protocol used in major markets globally to DC fast charge your car. Charging speeds vary from 15kWh/h to 250kWh/h. Generally requires installation of an additional transformer to support the power load.

Type2 - Level 2 AC charging. Typically charges the car to a full charge overnight. Most homes have this charger setup for them when buying a new EV. This doesn’t need any transformer upgrades in metro cities. Higher loads may be sanctioned by the local distribution company. Charging capacity ranges from 7.2kW to 22kW.

3.3kW Charging - Level 1 AC Charging. Can be used to charge 4 Wheelers and 2 Wheelers using a regular 15A socket. Takes 12-36h depending on battery capacity for a full charge.

DC001 - DC fast charging. Valid only in India. Typically used by B2B delivery 3 Wheelers.

Please note, that in my post from August 2022 I had not considered all the CPOs that were active, and my research was limited to the ones I knew. This time, I have tried to actively include as many CPOs as I could find on PlugShare and from the community. Still, if I have missed a CPO, please fill this form and I’ll include it in my next post.

Other disclaimers : I have excluded around 20 CPOs who largely don’t allow users to filter chargers by ‘type’ in their apps or they don’t have an iOS app (I don’t have an android phone). It is impossible to check each charger individually and add them to the list.

List of apps not included in the research - Bolt, Charznet, ElectreeFi, EVMithra, ElectricPe, Electriva, EV Cosmos, EV Dock, EV Joints, EV Plugs, EVRE, Evy, EVYatra, InstaCharge, Magenta ChargeGrid, MSEDCL, Sahy, TelioEV, Tryk, Tez, Veev and Volttic. The detailed reasons are mentioned at the end of the post for each app.

Now that all disclaimers are done, let’s get on with the details.

CCS2 in India

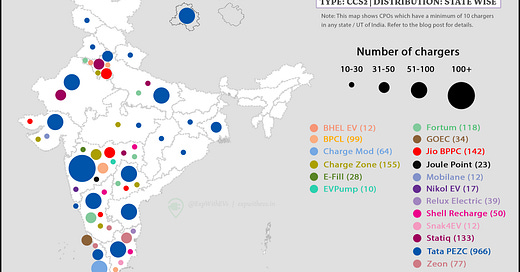

This is what the charging infrastructure currently looks like. This map focuses only on CPOs with at least 10 charging guns in a state.

From Aug 2022 till Feb 2023, the number of CCS2 guns have more than doubled. See below two graphics to understand the state wise distribution and change. Click on the links in the respective captions to check out interactive versions of these graphics.

Here’s the link to the interactive graphic : Link 1 & Link 2

Maharashtra is still the leader with almost 400 CCS2 chargers. Karnataka and Haryana beat Tamil Nadu to grab the 2nd and 3rd spots, pushing TN to the 4th spot.

Kerala (9th to 5th), Karnataka (3rd to 2nd), and Telangana (10th to 7th) showed a big % rise in the number of chargers installed. This allowed South India to comfortably beat West India when comparing CCS2 guns.

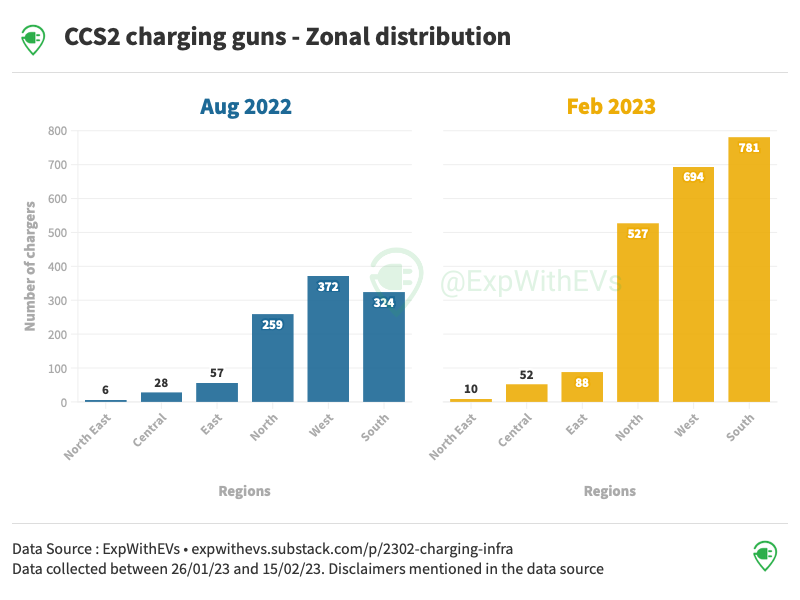

Zonal

There has been some increase in the number of chargers being put up in East, Central and North East India, but there is a lot more to be done in these regions. Tata Power is taking a lead in these regions, along with Recharge EV, JoulePoint, Jio BPPC and Adani TGEV.

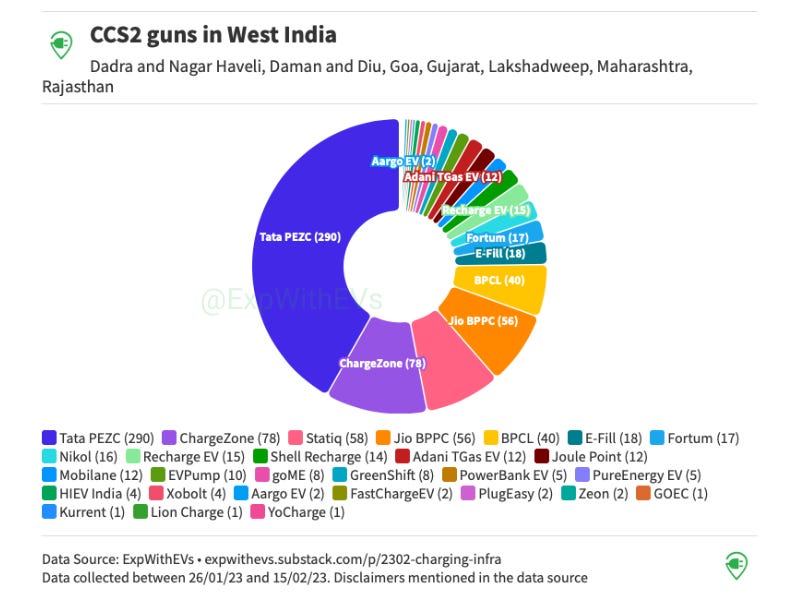

After Tata Power, we see the top 3 players maintaining their lead in the western region - ChargeZone, followed by Statiq and then Jio BPPC. West is the most crowded zone because 61% of the CPOs analysed have a presence in Maharashtra.

Statiq has been trying to make a mark as the de facto 2nd in command in the North region. However, it is easy to lose this position if they decide to focus on growing in multiple geographies at the same time. We will look at the state concentration of these CPOs later in the blogpost.

This is where the battle is very interesting. We have many decent sized players who are operating mostly in the south zone. I strongly believe that covering one state is less challenging than spreading the chargers across many states - state level rules and regulations. Plus, it is easier for the consumer too. Zeon and ChargeMod are prominent in Tamil Nadu and Kerala respectively. So I might be better off using just those apps when traveling in those states.

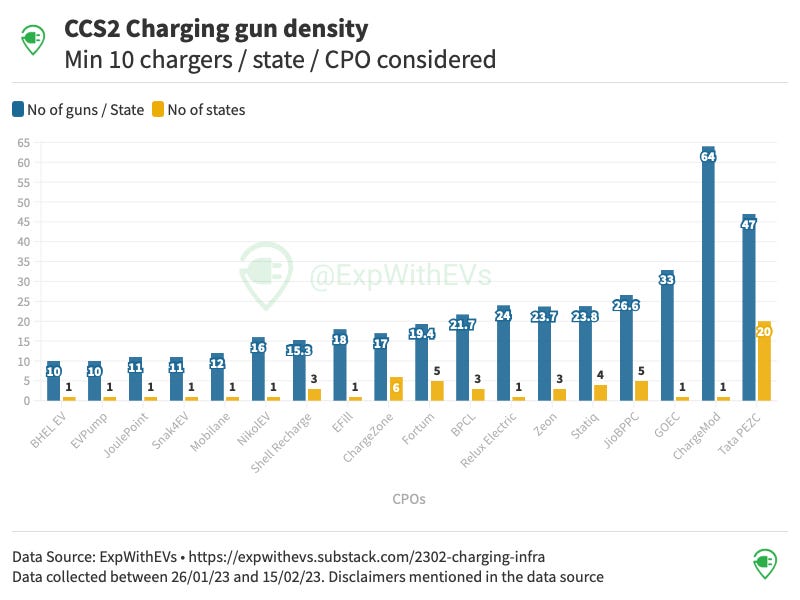

Density

The density of charging guns and their presence is important. Density for the sake of this analysis has been defined as - ‘minimum 10 CCS2 guns per state’, along with the number of states where more than 10 guns of that CPO are present. For example, JioBPPC has more than 10 chargers in 5 states, and 133 charging guns in these states at an average of about 27 charging guns per state. Higher number of states and guns is better.

Faulty Chargers

The biggest complaint of EV users is that many chargers aren’t working most of the time. I decided to look at the data reported by the CPOs on their apps to see how big of a concern this is. Disclaimer - this is a random snapshot of the data taken during the research period in the month of Feb 2023. Another assumption is that roughly 15% of Tata PEZC guns are down. Since Tata has too many chargers to count individually, I took a random sample of a few states and counted the non working chargers on their apps. I considered 3 states for my analysis. I did reach out to them for analysable data, but did not receive any response.

On average, 21% of the charging infrastructure or 1 in 5 guns are non operational. While the EV industry is still in its nascent stage and maintaining the infrastructure is a difficult task, 1 in 5 chargers down is not an acceptable figure. A reminder that this data is from the CPOs themselves. The numbers will be a lot higher if investigated on ground, which can be attested to by many users.

Let’s look at some of the biggest players in terms of self reported % faulted chargers on their apps.

There are atleast 3 CPOs who have 100% of their chargers faulty. BHEL EV, Chargengo, and FastCharge EV. Terrible! Seems like installing chargers is a compliance check box for them rather than the service actually working for consumers.

In this analysis I’ve ignored CPOs which have either upto 10% self reported faulty rate or the total number of faulty chargers are less than 10.

BPCL has 77 out of their 99 installed chargers faulty. It doesn’t make any sense for the consumer to install their app and consider relying on the BPCL charging network. Shell Recharge has 60% of their chargers not working.

Edit regarding BPCL - After the data collection was done, I learnt from Ionage (they handle the app for BPCL) that while the chargers are visible on the app, they aren’t activated. BPCL is currently in the process of getting all the chargers online. For a user there’s no filter to say that the chargers are being set up and aren’t currently working.

There are many failure points for a charging network, e.g - Power cut (yes, really!), charger hardware from OEM is broken, OCPP / OCPI service provider is not working or the telecommunications M2M IOT sim card is not working. It really is up to the CPOs to investigate what part is at fault and immediately rectify.

Metro cities

When you choose to drive your EV to a new city, it is critical for the destination city to support you with charging infrastructure. Oftentimes, I stay either with my friends or at hotels. Most of these places do not have a slow charging setup. It is also not always possible to slow charge your car with an extension cable. In these times, I have had to rely on the fast charging infrastructure within the city.

Here’s how our metro cities perform.

Delhi NCR has a massive lead over other metro cities in India. One of the possible reasons is that Delhi has seen high registrations of EV 4 Wheelers in the region. Higher sales of cars ensure that the CPOs also setup the charging infrastructure in the city.

Mumbai Metropolitan Region (MMR) comes in second in the list. Anecdotal evidence says that Mumbai also has many EV 4 Wheelers. One CPO head shared their concerns that they are unable to enter and flood Mumbai market with chargers. The biggest resistance they’ve seen are from the malls in the city. Malls usually provide ample parking space and the infrastructure can be installed easily, but I’m yet to understand their reasoning.

Bengaluru is a close third and has the potential to overtake Mumbai by the next analysis. One thing these numbers show is that metro cities are ripe for disruption to set up fast charging networks.

As we’ve seen earlier in the post, it is relatively easier to set up AC Type2 slow chargers as compared to DC Fast Chargers. Clearly, fast charging is not widely available in cities, but what about slow charging?

AC Type2

Why are AC Type 2 chargers needed in cities?

Many people in India are struggling to get slow charging options setup in their buildings. Anand Vedula from Bengaluru is fighting a case against his housing society to get permission to install a charger in the building.

It is not recommended to fast charge the car every time, unless you have BYD’s blade batteries. Slow charging helps elongate a car's battery life, and we must enable this option for EV owners.

On my recent trip to Delhi, I had an overnight halt at Vadodara. I couldn’t find a single 7.2kW charger close to where I was staying. Having a charger would have cut down on at least one big fast charging session for me during my journey and would have helped save anywhere between 30-75 mins during driving hours. Also, a side benefit of using slow chargers in cities - car owners don’t have to worry about parking the car. Our cities are usually cramped and it is often difficult to find a parking spot. Win win.

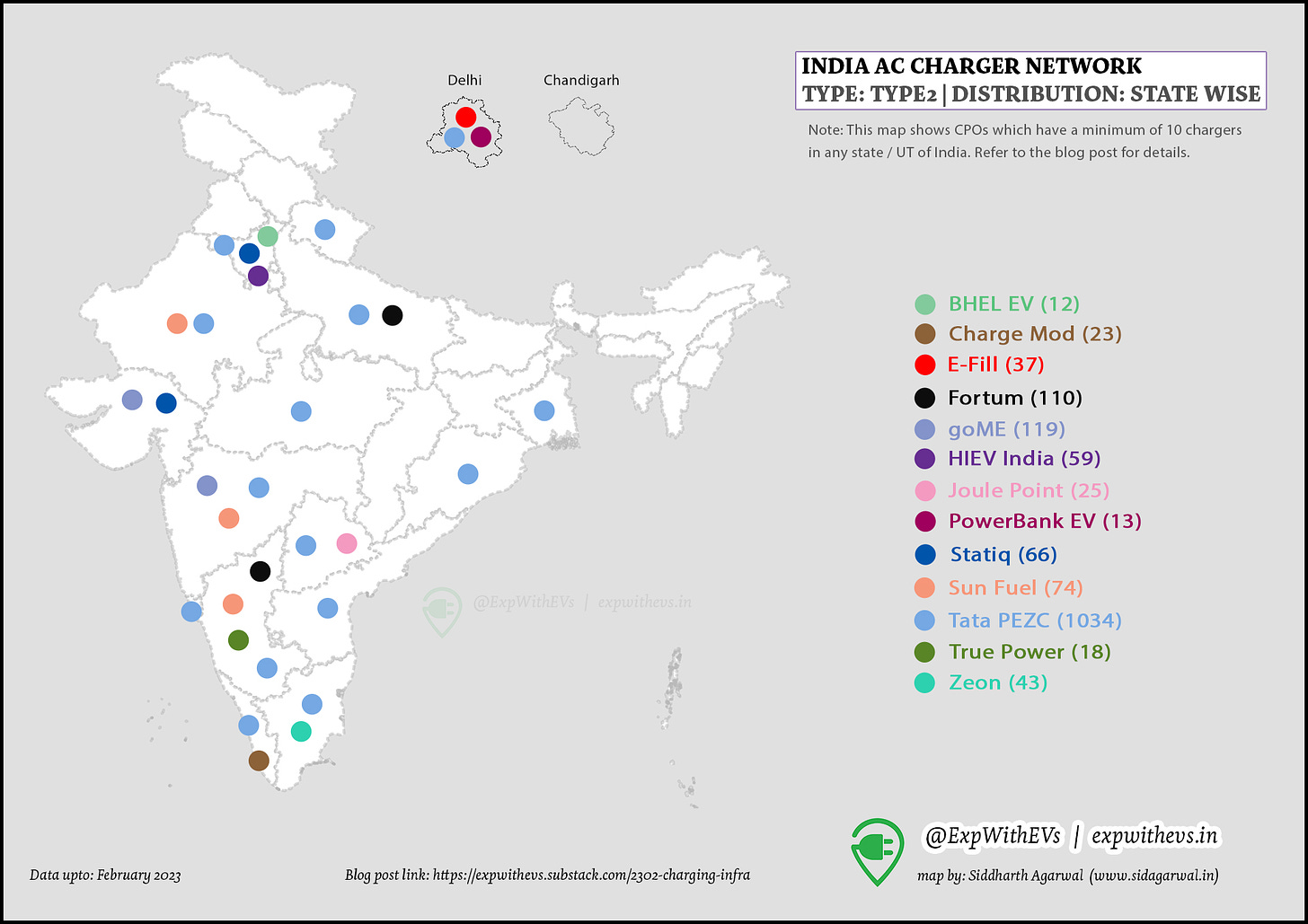

This is the current state of AC Type 2 chargers in India. I’ve only considered CPOs with a presence of at least 10 Type 2 chargers in a state / UT.

We see that there are only 3 companies that have more than 100 chargers in India - Fortum, goME and Tata PEZC. My hope is that we should have at least 10 more companies in the next 6 months with more than 100 Type2 chargers. Having more Type2 Chargers is better for the grid as owners can charge their car overnight. This puts less load on the electricity grid and allows for owners to save time while traveling.

Zonal Distribution

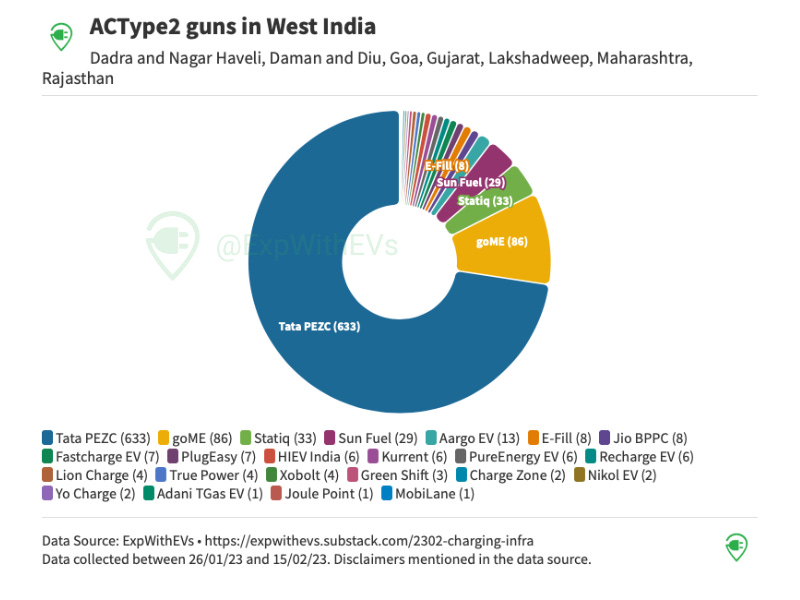

The West zone clearly dominates in this space, with South and North competing closely for the second spot. All zones are dominated by Tata PEZC. West Zone’s second place is taken up by goME chargers, followed by Statiq and SunFuel.

North Zone has many players. Shouldn’t really consider HIEV India as the second in position because most of their chargers don’t work.

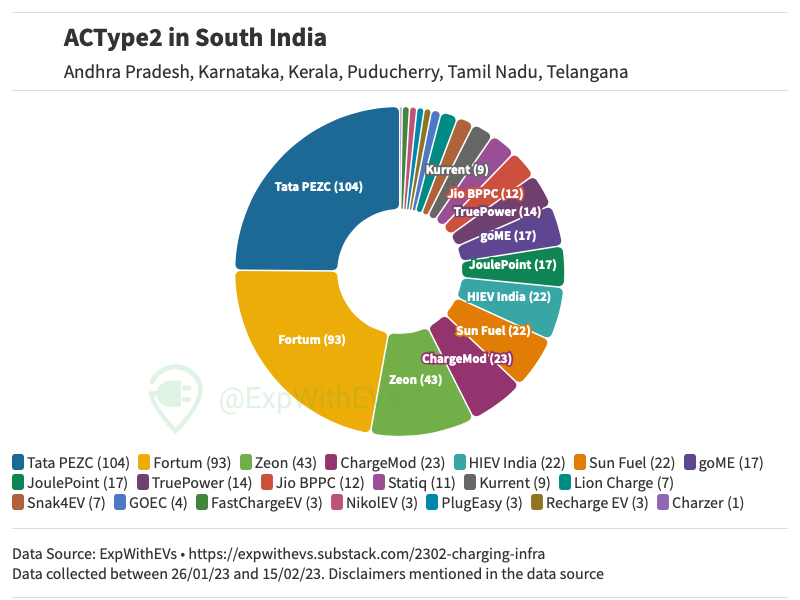

Fortum is leading in the South zone and close to beating Tata PEZC, mainly due to their massive 40+ charger installations in a few malls in Bengaluru.

Enough number crunching for this post. Now onto some of my findings while going through each CPO app.

Wishlist from CPOs

Since most CPOs read my blog, I’d like to present them with my wishlist.

Must have and slightly difficult to implement - Booking a slot :

Many CPOs already provide for booking slots as an option. However, some or the other features are missing in all apps. Here is how I’d like to see it get implemented.

While it is a great feature to have, users may have a tendency to book a slot and not show up or may genuinely not be able to make it. To avoid abuse, CPOs should block a minimum amount from their wallet to book a slot. Once the user reaches the charging spot +/- 20 mins for the time they’ve booked, the blocked money should be used for the charging session.

Let’s say Mr X has booked a charging slot at Tata PEZC for 1600h. Mr. A arrives at the same charger by 1520h. Mr. A should be allowed to initiate the session. He should also be shown a warning that the charger is booked from 1600h and the session will automatically end when Mr X shows up. The CPOs already have location permission within their apps. So, when Mr X reaches the charger, there should be an option on the app to “activate” the booked charging session. This will end Mr. A’s session and the charging gun will be unlocked for Mr X to use. Obviously if Mr. A is not around and the charging gun isn’t released, then the CPO should reach out to Mr. A and update them about the session. This allows for maximum utilization of the charger.

Incase Mr X doesn’t show up (within specified time limits) for the booked slot, then the booking amount should be deducted from their wallet. There should also be an option for Mr X to cancel the booking because there are too many variables which can cause delays to reach a particular charger.

Must have and easy to implement - Charger Status:

Most apps today only have a feature showing that the charger is Busy / Unavailable / Available. CPOs should add a “Finishing” status on the app. ChargeZone and some other CPOs do it. However, everyone else can easily adopt this feature. Allows users to plan better.

Along with “finishing” status, some CPOs are also showing “last active” and “last used” data points. This is extremely critical for users. Reliability of the charger can also be predicted based on these data points.

Many small CPOs don’t necessarily have a software team to build and maintain the app. Often this work is outsourced to a third party. Most times, these third parties also provide the CPO with OCPP / OCPI protocol. This is an open protocol allowing communication between the charger hardware and the CPO’s backend. They also provide the CPO with an app. That is why many of the apps have the exact user interface, except the color scheme. These third-parties should integrate and push these features for all the apps they are servicing. I’m looking at you, Numocity!

Must have and difficult to implement - Non Wallet integration:

In my previous post I’ve already spoken about getting rid of wallets. Without wallets, CPOs have two ways to collect payments. The first one is Postpaid, i.e. payment collection after the charging is done or secondly, via blocking a mandate on the user’s card / UPI.

Fortum used to have a postpaid method of collecting payments. On my podcast with Fortum Charge and Drive India’s head - Mr. Awadhesh Jha, he mentioned that Fortum had high receivables. The users are expected to clear their payment after the charging is done. However, many users would simply create new accounts or clear the payment only when they had their next charging session. Thus, trusting the consumer to pony up hasn’t made business sense in India. The postpaid method of payment however is a standard practice in Europe and USA.

According to me, money being blocked on UPI via a mandate makes the most sense in India. Granted, many EV consumers would most likely have a credit or a debit card, but UPI is widely used. Or another option is to deposit INR 1000 (or whatever is the average amount of that user per session, or the maximum amount based on the battery capacity of that vehicle) with a payment gateway like RazorPay. Once the session is done, the payment gateway can refund the balance amount via the same UPI id, or can issue a demand for the balance.

Good to have and difficult to implement - AutoCharge / Plug n Charge:

Some CPOs are already working on this feature. Once the car is connected to the charger, the CPO should be able to identify the user and initiate charging based on the money in the wallet or via pre-authorized mandates. This makes the whole experience a lot smoother for the consumer. From my discussions with CPOs and Charger OEMs, except Tata cars, this feature is possible in almost every other Auto OEM. With some polished software, we can expect this to be rolled out real soon for most CPOs.

As far as Tata is concerned, they have the highest number of cars on the road and the highest number of chargers. It really depends on them when they would want to flip the switch and enable this feature.

Must have and easy to implement - Error codes:

If you have charged your EV enough times, you must’ve received a charging error at least once. If not, you should consider yourself lucky and maybe even buy a lottery ticket?! Presently, if there’s any error during a charging session, then the charger display shows an error code. Oftentimes, you have to look up the error code online in hopes that there’s an explainer somewhere, or ask within the community. Trust me, I had to do it. Not everyone is equipped to do this. It would be great if the CPO can send a notification on the app itself clearly stating what the error means.

The notification should also include whether the issue is fixable by the driver (say the charger just needs a restart) or if it needs intervention by a professional. In case of the latter, obviously the company appointed professional should be notified immediately by the CPO and the user can talk to them if needed. If the power to the charger is cut off by the local electricity board, then the notification should say so. That way, the consumer knows that the CPO isn’t to blame but the local electricity board.

Good to have and slightly difficult to implement - CarPlay / Android Auto :

Many consumers use CarPlay / Android Auto. They are often looking for a charger while driving. Makes total sense to have a CarPlay or Android Auto support. None of the CPOs currently provide this.

Must have and easy to implement - Rooftops at the chargers:

I can’t believe that I have to say this, but there needs to be a roof on top of the charger as well as the parking space for the car. This protects the charger as well as the car & car owner from continuous static exposure to the sun and torrential rains. Seriously guys, please put up a roof.

Must have and easy to implement - Dedicated parking for EVs at the chargers

PAINT THE PARKING SPOT! I’ve seen countless instances of charging stations being blocked by ICE cars. ICE cars may have parked it there without seeing / knowing that there is a charger present.

Only certain kinds of people would park in a reserved spot not meant for them. Nothing can be done about them. With the painting and appropriate signage around, most of the drivers would happily comply.

Must have and easy to implement - Reliable phone support

It is imperative to provide reliable phone support by CPOs to their customers. We have high number of non working chargers. Having a reliable support centre can help resolve many queries for the consumers.

I reached out to every CPO via their app. I got a No response / Switched off / No phone number for 22 out of 48 apps. This is just terrible. Data has been collated in my sheet here.

Unfiltered comments about CPOs and their apps :

- Adani EV has two apps for charging. One of the apps is focused on their private residential complex EV charging and another is their airport based DC Fast Charging.

- Must commend JoulePoint on having their chargers in cities like Jorhat, Assam. Makes it easier for EV users to travel to north eastern states. However, their iOS UI on dark scheme doesn’t show the charger capacity.

- ChargeMod has covered Kerala in great depth. If I am traveling in Kerala, I probably don’t need to look for any other chargers other than ChargeMod. Of course, Tata PEZC is always an option.

- FastChargeEV has all their chargers broken. Either the app doesn’t update the real time status, or they are legit broken. Either way, not a good sign.

- JioBPPC which has Numocity as their CMS provider, has added a trip planner feature. Among the first ones to do so with the ones using standard CMSes, afaik.

-HIEV India has a high % of their chargers not working. Maybe I caught them on a bad day. Also, I was unable to register on their app. Used Guest login to check out the details.

- LionCharge’s filter wasn’t working correctly in my first pass of the app, but it seems to be working now.

- Statiq lists SunFuel chargers on their app because SunFuel’s OCPP provider is Statiq.

I think that there’s wide space for charging point companies to chip away at Tata Power’s lead. On my 2500 km Mumbai - Delhi - Mumbai trip I consciously tried to use non Tata PEZC chargers. I ended up using it only once because other CPOs charging stations didn’t work. The objective of the trip was to see if I can do this without using Tata’s network. We are almost there. I am rooting for other players to capture the wallet share of EV consumers. A monopolistic scenario isn’t ideal for consumers.

Fin

I love collecting my trip data and sharing it with the community. Running this blog has been a delight, and I realize that it is important to document the growth of the Indian EV charging ecosystem. It would be great if the mainstream auto media too played a role in this story.

Being a consumer who is passionate about this space, I spent a month collating all the data and writing this analysis. Despite some offers, I have not accepted any sponsorship from anyone in the EV community. This allows me to provide an independent analysis about the industry. If you’ve enjoyed reading the article or if you’ve found the data to be useful, please consider supporting me. There are two ways to support my work.

You can send money to my account directly via UPI - expwithevs@ibl . For international readers, you can send money via : https://www.buymeacoffee.com/expwithevs A part of the money collected here will be shared with my friends who help me run the blog.

I also run ActiveBuildings, an indoor air quality monitoring company. Mumbai Indians and the Tata Group trust ActiveBuildings to help manage their air quality. You can reach out to us at activebuildings.io to get your home / commercial office evaluated for indoor air quality. Air quality tests start from INR 699/-. Get a report to understand what’s right and wrong with your space. Maintaining good air quality is critical for good health and well being of your employees / residents.

Why some apps were not included in the research :

Bolt - Unable to filter out 7.2kW charging stations. There are too many 3.3kW to look and search for. Had sent out a request for data, but never received any info.

Charznet had no filter, so it was ignored.

ElectreeFi - Unable to search for chargers across the country. Can only search for chargers in my vicinity, which doesn’t help me with this research.

EVMithra has a similar user interface like ElectreeFi. Unable to search for chargers outside of my area. Have to skip it. Another important reason to show chargers outside of my vicinity is to see if a particular charger in a different city is working or not and the user can plan their trips accordingly.

ElectricPe again doesn’t have a working filter. Has many 3 pin plug points.

Electriva’s filter isn’t working, so didn’t include them.

EV Cosmos sign up process was broken. Tried multiple times and failed. When I could successfully sign up, I realized it is a dashboard for the CPO to see how much electricity has been consumed at what charger etc. Haha. Plus they have a Sri Lanka connection. Interesting.

EV Dock has a fast charger only at their office. Not including them in the research.

EVJoints doesn’t list the chargers on their web platform and they don’t have an app either.

EVPlugs is an aggregator which has only Tata PEZC and EFill chargers. Skipped them.

EVPlugnCharge had no filter, so it was ignored.

EVRE app doesn’t have a filter by connector type. Can’t expect to look at every listed charger to see what guns it has.

Evy is an aggregator which has 10+ CPOs, but not all chargers from each CPO are mentioned. Nor is the payment enabled for all chargers.

The govt app EVYatra hasn’t been able to integrate payment options for many CPOs. They also don’t have all CPOs on their app.

InstaCharge has multiple language options! That’s a welcome first. But I can’t look at the app without registering on PayTM. That’s a no go for me because I don’t have PayTM and because I just want to see if there are chargers for my use or not. Edit - On 26th Feb 2023, InstaCharge issued an update wherein linking to PayTM wallet is not mandatory.

Magenta ChargeGrid app is horrible to use. As far as I know, they are focussing on B2B charging infra and not B2C. So skipping it.

MSEDCL has chargers that are repeated in other apps, like TelioEV, which is a charger aggregator. Hence not included.

Sahy has the same chargers as NikolEV. So ignored Sahy. Alphabetical order took priority, sorry!

TelioEV app wouldn’t open on my phone.

Was unable to find the Tryk app on iOS.

Sign up process on the Tez app is broken. Couldn’t register on the iOS app.

Veev app was not considered because their app is no longer available. It was previously covered.

Volttic doesn’t have an iOS app and I didn’t have a spare Android phone.

This piece can be re-published (CC BY-NC-SA) with a line mentioning ‘This was originally published on ExpWithEVs.in’ and a link back to this page. In case of re-publishing, please alert priyansevs@gmail.com

Text, data and graphics - Priyans Murarka

Map and copy editing - Siddharth Agarwal

Auto charge works very well for my nexon ev in all Zeon chargers

This space will have massive consolidation, lot of these companies will die