2503 EV Charging Infra

State of EV charging in India - 7th edition - March 2025

Edit : Jul 2025 : If you are looking for the latest edition of EV Charging Infrastructure Reports, then please follow these links :

ExpWithEVs Products and Services

This is the seventh edition on the state of Indian EV Charging infrastructure. This report contains charts depicting trends across the industry over two years, CCS2 and Type2 connectors, leading charge point operators in each zone, non working connectors, infrastructure in major metro cities across the country.

Here are some of the older reports :

September 2022, February 2023, September 2023, February 2024, September 2024, December 2024

And now, March 2025.

P.S. : The disclaimer about each report is mentioned in the above link.

Last week, we released an update to EVInfraBI, which looks at the granular charging infrastructure in great detail. EVInfraBI lets you look at individual charging locations and their geographical properties. It is a great tool to go in-depth and understand how these CPOs are expanding their network across India. Here’s the blog post talking about it.

Today, we look at the charging infrastructure from a high level overview. We look at the trends and growth of the charging infrastructure in India, across the CPOs and states.

This report is hosted on PowerBI and you can get your hands on it today. Alternatively, we’ve also come up with an Executive Summary in a PDF version which is also available today. You can jump to the relevant section below. Clients with valid 2503 license to EVInfraBI get the Executive Summary for free.

Premium subscribers to this blog will be able to see additional charts at the end of this article. Annual subscribers get 10% off on the above purchases, repaying the subscription already :)

We are currently covering public connectors from the following CPOs - Aargo, Adani Total Gas, Audi/ChargeZone, Bijlify, BPCL, chargeMod, ChargeZone, Ecoplug, eFill, emobility, EV Pump, EV Charge Partners, EV Dock, EVOK/chargeMod, Evolute Surat, Gentari/ChargeZone, Glida, GMVN/Statiq, GOEC, GoEgo, HPCL, Hyundai/ChargeZone, Hyundai/Statiq, Indus, IOCL, Jio-bp, KSEB/chargeMod, Kurrent, LionCharge, Mercedes/ChargeZone, Mobilane, NikolEV, Plugeasy, Rebolt, Recharge EV, Relux Electric, Replenish, Shell Recharge, Shell Recharge/Statiq, Statiq, SunFuel, Tata PEZC, Verde, Volt Panda, Voltran, Volttic, Xobolt and Zeon.

Please go through the data disclaimers and disclosures section at the end of this post.

All the data will reside on EVTrendsBI - an interactive Business Intelligence tool built by Garvit and me. This is extremely lightweight and is hosted on PowerBI. It contains data from the previous charging infrastructure reports till date. This interactive tool will allow you to view the historic trends of growth of charging infrastructure as well as who stands where today. There’s a lot of analysis that can be done with simple charts, such as comparing the growth of different CPOs over time, identifying regional trends in infrastructure expansion, mapping EV sales data and pinpointing CPOs and states with high concentrations of non working connectors.

We also have an executive summary in PDF format hosted on our credentialed platform.

Let’s take a look at the charts from EVTrendsBI here.

Let’s dig in

The CCS2 connectors have grown 20% in the last three months and Type2 connectors have grown around 14%.

This is after the fact that a major CPO like Jio-bp have marked previously public connectors as private at many of their charging hubs. Adani Total Gas had previously incorrectly marked private chargers which are now correctly classified as private, resulting in reduction of connectors.

Zeon and ChargeZone have upgraded their existing chargers add added new ones.

With complete access to EVTrendsBI, you can dive into the trends and see how CPOs have ramped up their installations over the years.

Pan India Zonal Growth

The West has extended its narrow lead over the South. North, East and Central regions have also continued to grow. A couple of connectors have been decommissioned in the North East region.

The South region has seen faster growth in terms of Type2 installations as compared to the West zone. A single Type2 connector has been decommissioned in the North East.

A complete trend chart from September 2022 is available for premium subscribers at the end of this article.

CPOs

We now have a new leader in CCS2 connectors!

IOCL has overtaken Tata Power in terms of CCS2 connectors. Till last year, Tata Power narrowly led IOCL by less than 100 connectors. Today, IOCL leads Tata Power by four times that difference.

Jio-bp has lost its third rank to BPCL. HPCL has leapfrogged three private players to take up the fifth spot. All three musketeers - IOCL, BPCL and HPCL have improved the total number of CCS2 connectors and dislodged private players. These top five players have around 60% of CCS2 connectors in the country. Out of the top five CPOs, three are Public Sector Entities.

The order for rest of the private players i.e. Statiq, Glida, ChargeZone, Adani TGas and Zeon has stayed the same.

Premium subscribers can see the charts with numbers.

IOCL has more than 25% of the public Type2 charging infrastructure. The other players are significantly behind. Bijlify has jumped from 7th position to 3rd after almost doubling their Type2 infrastructure in the last three months. But Bijlify’s chargers are also widely spread across in housing societies and RWAs. (Residential Welfare Association)

Jio-bp has seen a reduction in their numbers because they’ve marked previously public Type2 connectors as private.

ChargeZone has leapfrogged to seventh position from previously fourteenth by adding close to hundred Type2 connectors in three months. Detailed numbers are available for premium subscribers.

States

Maharashtra continues to have a solid lead over all other states. In September 2024, Karnataka was second on this list. In December 2024, Gujarat overtook Karnataka to claim the second spot and now in March 2025, Tamil Nadu overtook Karnataka for the third spot.

Wonder how long will it take for other states to cross Maharashtra’s count?

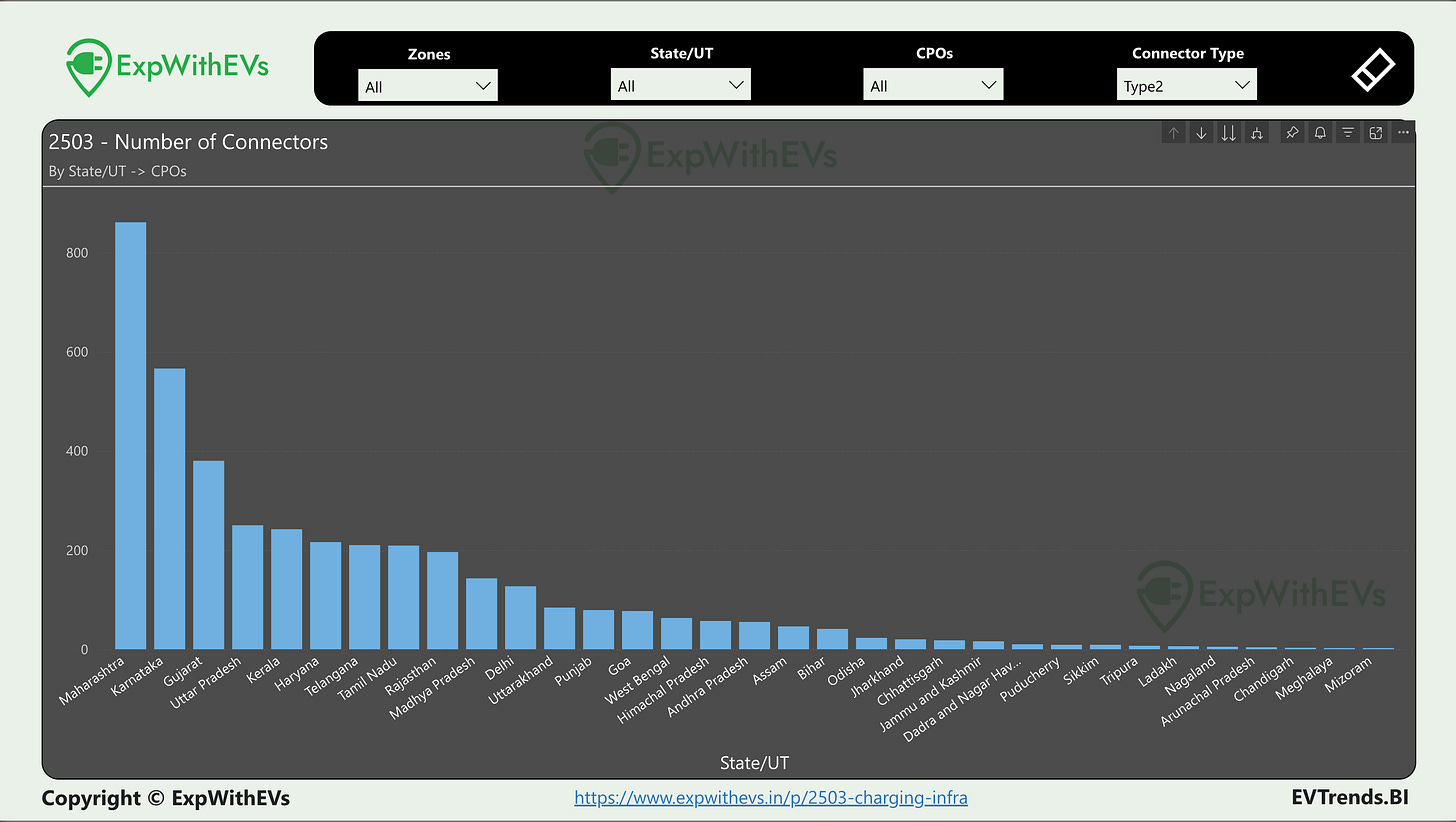

Let’s look at Type2 Public connectors in India

The order for the top five states have stayed the same. From December 2024 to now, Karnataka has installed more public Type2 charging connectors than Maharashtra. Some CPOs removed Type2 chargers from Uttar Pradesh, but it still held its fourth position in the chart, with Kerala ready to overtake very soon.

Detailed charts available for premium subscribers at the end of this post.

Non working CPOs

In this section, we will focus on the non working connectors by majorly public run companies. Before we get to that, lets understand the trend and pattern of non working connectors so far.

33.65% of CCS2 connectors were not found to be working during our study spanning across March 2025. Similarly, 43.61% of Type2 connectors were not found to be working during the same study.

34.14% of CCS2 connectors and 46.78% of Type2 connectors were not working in December 2024. The non working connector % has gone down slightly. The industry needs to take a hard look at what’s wrong and how to fix it.

While the industry does that, every Indian tax payer should pay attention to how Public Sector Companies are spending our hard earned money on charging infrastructure.

IOCL has over 2000 non working CCS2 connectors, around 95.8% of their total CCS2 connectors. BPCL proudly comes in the second place with 73.6% of their CCS2 connectors not working. I wrote about this exact issue around two years ago for The Ken, but there has been no improvement in their services. HPCL with a fewer number of chargers is doing fairly well at only ~30% of non working CCS2 connectors.

Evolute Surat, a CPO service run by Surat Municipal Council, has around 200 connectors with a 2% fault. What is Evolute doing differently from the rest of the public players?

Are the Public Sector Entities performing any better with Type2 infrastructure? Let’s take a look.

Looks like not. 94.2% of IOCL Type2 connectors, totalling over 1000 connectors are not working. Evolute Surat shines here too, with 2 non working Type2 connectors out of 100.

Where is the outrage? Where is the responsibility of these CPOs, equipment suppliers? Who won these tenders and why were low grade equipment supplied to them? If it isn’t the charger hardware then why has the management not enforced improving the utilization of public’s money? If you can help me file RTIs and get to bottom of this, then please drop me a line at priyans@expwithevs.in

Are you interested to see where your competition lies?

Get this in your hands

There are two ways to go about this. Before we get into the details, please note that I will be getting the GST for ExpWithEVs by end of April 2025, post which there’ll be an additional 18% tax on all transactions.

EVTrendsBI

This PowerBI tool consists of 12 PowerBI charts with varying slicers. You can take a look at this article to see sample charts.

Three charts talk about trends in growth of connectors, zonal distribution and non working %

The next six charts are about 2503 data dissecting into distribution by State, drilled down to CPOs; a map to see the numbers across states visually, connectors by CPOs, non working connectors by CPOs, non working connectors by States, and Connectors across metro cities in India.

One chart is called Playground which allows you to explore the data the way you want.

Two charts are about electric four wheeler registrations statewise and RTO wise over the last few years via Vahan.

An annual subscription is available for corporates. This will include three additional data updates, ie in July 2025, October 2025 and January 2026.

Please read the terms and conditions for the offer mentioned in this article carefully before buying.

Please note, the data cannot be exported in CSV or Excel format.

Non premium subscribers get two licenses for their company. Tax invoice can be shared on request. Bank transfer options are also available. TDS can be deducted when paying through bank payments.

Premium subscribers can use this link to get access to 2503 EVTrendsBI.

Premium subscribers get four licenses for their company. Tax invoice can be shared on request. Bank transfer options are also available. TDS can be deducted when paying through bank payments.

Executive Summary - PDF

The executive summary PDF contains the following :

Map for CCS2 and Type2 chargers for states across India

Number of CCS2 and Type2 chargers by CPOs

Number of CCS2 and Type2 chargers by states

Non working chargers across CPOs

Non working chargers across states

Number of CCS2 and Type2 chargers by CPOs for each State / Union Territory

Non working CCS2 and Type2 chargers by CPOs for each State / Union Territory

Number of CCS2 and Type2 chargers by State / UT for each CPO

Non working CCS2 and Type2 chargers by State / UT for each CPO

Here’s a sample video of the PDF report.

This document is hosted on our credentialed platform and can be accessed only through it. You will not be able to download the PDF. Please note, there will be no data updates to the PDF and the data is restricted to March 2025.

Regular ie non premium subscribers will get access to two licenses.

Annual premium subscribers can save money (discount!) and get four licenses for their organisation.

Collection

We’ve significantly enhanced our manual data collection processes, supported by our growing team and streamlined workflows. We are expanding our team and seeking individuals to assist with data entry tasks. If you're interested, please fill out this form.

Hygiene

We improved data hygiene by checking each CPO app three times. The latest data for all CPOs was collected in March 2025. Our data refinement process identified private, restricted, or captive chargers, and effectively purging them from the database. The rise of aggregator platforms has forced us to be more diligent while collecting the data and avoid duplication!

How do I use it?

EVTrendsBI is hosted on PowerBI. If your company already uses Microsoft products like Teams and Outlook, then it is highly likely that you have access to PowerBI. If not, it costs around US$10 / user / month to get access to PowerBI Pro.

You can also sign up with a free Microsoft Fabric Account to get a 60 day trial for PowerBI Pro. It is mandatory to have a business email address to sign up for PowerBI.

We are happy to train your team to use PowerBI for EVTrendsBI.

Executive Summary is a PDF hosted on a platform for which credentials will be emailed to you.

Acknowledgement

EVTrendsBI was created by Priyans Murarka and Garvit Singh. This wouldn’t have been possible without the efforts of our data entry team.

Disclaimers

The data in EVTrendsBI is static but will keep getting updates every three months.

While we’ve taken great care to ensure data accuracy, we recommend verifying the information independently before making decisions. If you notice any discrepancies, please contact us at priyans@expwithevs.in.

Disclosures

[2023] - I had conducted a 3rd party audit of Glida's charging network and was paid for it.

[2023] - Charge Mod, EVOK, TataEV, Ador Digatron have paid for my travel to attend their events.

License and agreement

This intelligence tool and the PDF report is intended for the authorized buyer / organization only.

Distributing this tool or the outputs from this tool in any form outside the authorized buyers is not permitted and will be considered copyright infringement.

All rights reserved with Priyans Murarka @ ExpWithEVs.

The data from here and this article cannot be repackaged or sold without explicit written permission of ExpWithEVs.