What's cooking in India?

Ather Energy, another electric two-wheeler manufacturer, files for an IPO.

As major electric two-wheeler startups in India hit the domestic bourses, we look at what makes them tick and why there is a rush for public money.

In this two-part series, we also examine why India is the most important two-wheeler market in the world and why the Western world E2W start-ups have no advantage over high-quality homegrown Indian players.

InsightEV is creating the world’s premium knowledge, intelligence, and data repository on the electric 2W and urban mobility industry. We strive to connect investors with the right start-ups and vice versa while sharing knowledge.

This is Week 22 of this newsletter. Connect with us at editor (at) insightev.com

Private Money Funded E2W Startups with a Software Industry Cheatsheet

One of the universal challenges we see with electric two-wheeler startups worldwide is funding or the need for it. Little private money is floating around these days, and the business's commoditized nature throws a spanner in creativity. In the absence of any major product supremacy, scale is the savior.

India has a lot of that. As a result, deserving Indian electric two-wheeler start-ups have had no problems raising substantial capital during 2018-23.

Then two things happened—first, the global taps of private capital liquidity dried up over the last two years, and second, some Indian startups became arguably overvalued elephants while piling up huge losses. That’s okay in the software industry, where burning money to onboard long-term, almost-captive users on the platform is a norm. It is not so in the hardware industry, where subscription models are a rarity, and the customer is never captive.

Add to that, whatever reduction in BoM costs may have been achieved due to falling battery prices have largely been negated by the reduction in Indian government subsidies.

It was risky for private money to invest at these high valuations, hoping for a significant upside. Especially when the gap between BoM costs and retail prices wasn’t narrowing fast enough.

The taps dried.

Enter public money…also called the guys left holding the towel.

The IPO way

With private money no longer an option, large startups like Ather Energy and Ola Electric have been facing a funding crunch in the last two years.

It's a tricky situation where the more you sell, the more you bleed. And if you slow down sales, you become irrelevant. No one wants to be irrelevant.

So, first, the E2W market leader Ola Electric hit the bourses in early August 2024 with an opening market cap of USD 4.5bn. This was about 18 percent lower than their last fundraise—Series E in October 2023—which valued them at USD 5.4bn.

However, the initial euphoria on the bourses saw this market cap exceed an eye-watering USD 7.0 bn, making Ola the world’s richest pure-play electric two-wheeler manufacturer. Things have cooled down since then, and Ola Electric’s market cap hovers around the USD 5.0 bn mark as we write this.

Now, Ather Energy, India’s first real electric scooter startup, has filed its Draft Red Herring Prospectus (DRHP) with the Securities Exchange Board of India (SEBI). SEBI is the SEC equivalent in India.

Given the time it takes for any DRHP to clear the approval process in India, we should see Ather Energy listed by the end of this year or early next year.

The Indian E2W market - Pecking Order

Ather is fourth in the sales pecking order behind market leader Ola, Bajaj, and TVS in that order. Last month (September 2024), it sold over 12,500 electric scooters. That was a 14 percent share of the E2W market in India, compared to Ola’s 27 percent.

We don’t read too much into this pecking order, as it has changed multiple times in the last five years. Between FY 2020-22, the market was led by Okinawa and Hero Electric (not to be confused with Hero MotoCorp). Both made scooters from cheap, sourced-from-China kits. With the Indian government linking subsidies to localization, both companies came under pressure.

The generous subsidies also boosted Ather Energy and new entrant Ola Electric, which are more localized and better engineered (than Chinese sourced products). Ola challenged its bigger rivals by offering scooters across a wide price spectrum. Neither Okinawa nor Hero Electric could survive.

The pecking order is changing even more as we write this. Ola Electric has rapidly lost market share in the last six months. We blame it on the IPO excitement, climax, and post-IPO lethargy. Start-ups push the pedal on sales before the IPO to hit the markets on a high. At times, this means throwing money for sales and bleeding harder which is okay as the listing would get them a pot of cash. Post listing, a sense of responsbility towards making profits stops them from bleeding too fast.

Ather’s aspired valuations at listing are unclear, though a USD 1.5bn—2.0 bn is not ruled out. Depending on how one evaluates it, this may be shockingly high, just about okay, or even low from a long-term perspective.

We don’t know.

Ather doesn’t make money, and Ola is similarly allergic. Both fit the Silicon Valley startup model of claiming to disrupt while burning money. While that may be okay where they operate, stock market analysts cannot take any publicly traded company metrics and start evaluating Ather or Ola on that. A negative PE is a negative PE, anyway you look at it.

Enthusiasm for the sector

Not making any profits is not a deterrent. That has not stopped high-profile investors from investing in both companies. ‘Electric mobility is a trend that will take over the world,’ seems to be the hope and prayer that investors have posters of on their office walls.

Ola Electric counts Softbank, Temasek, Hyundai, and Tiger Global on its Captable. Ather Energy has the Government of Singapore Investment Corporation (GIC) through its subsidiary Caladium Investments on the captable.

Importantly, India’s largest ICE two-wheeler manufacturer, Hero MotoCorp, is Ather’s biggest investor, making Ather Energy a big indirect EV play for Hero.

Even after the IPO, almost all the above investors remain on the Captables, so confidence levels remain high.

But what drives this confidence?

The Vastness of India

India is big in every way. It is big in landmass and the biggest in population, with some of the world’s highest population density in large urban centers. A lack of quality mass transit systems within large urban centers means the masses must use two-wheelers.

The Indian two-wheeler market is the largest in the world. For FY 2024 (Apr 23-Mar 24), India reported registrations of 18.5 million units. Include exports and Indian manufacturers for 22 million units. With China slipping last year, India is now the global volume leader. Even at this high volume, the market is still growing at a healthy double-digit percent pace, making up the volumes it lost during the COVID years.

This is a highly consolidated market. The top four brands account for 83 percent of the sales. If you add the top six brands, that’s 93 percent of the market. That means there is enough meat on the bone for any serious player - the biggest player, Hero MotoCorp, sold 5.4 million two-wheelers last year.

Importantly, India’s two-wheeler market is largely a homegrown industry. Of the top six brands, only Honda and Suzuki are foreign. Yamaha is not among the top six, and Kawasaki, BMW, and everyone else are fledglings.

Add the fact that India is a fast-growing, large-sized economy, and we see a very strong tailwind for anyone big in India.

India: Nowhere Near a Sales Peak.

A high sales volume should eventually lead to saturation and a plateauing of sales, followed by a slow decline. However, India is not even close to the apex yet. The country has a huge population base. At 1.4bn+, it is the most populated country in the world. By putting the two-wheeler park at 150m units, the penetration levels are at 10.5 percent. In a similarly population-dense Indonesia, the same levels were estimated at 85 percent in 2023.

It can be forecasted in an oversimplified way that India has room to grow. If the economy stays on the right track, we will see annual two-wheeler volumes peaking at 50m units per year, not before that.

Please take the above with some salt, as India’s per capita GDP, at USD 2400, is half that of Indonesia, at USD 4800. However, even considering that, there is an unparalleled growth potential.

Large players in Consolidated Markets are Scary

The world should be afraid of players from highly consolidated markets. They have enough security and scale from their home market. India’s biggest players have been selling millions of two-wheelers every year. They have been doing that for decades.

To put it in the right perspective, that’s more two-wheelers than what BMW sells in a decade or what a Ducati and Triumph have sold together in their lifetime.

It can be argued that the two-wheelers sold in India are basic commuter machines. Most sales are sub 125cc. They are not comparable to an R 1300GS. The European retail price of an R 1300 GS is about 30X that of a popular Honda scooter in India. We give you that.

But even in a commoditized market, there is a quality characteristic. The commoditized two-wheelers in India are unlike those in China. Indian two-wheelers are high quality, and it is conceivable that the best-selling models run more than 200,000 km without any trouble and spend more than a decade on the road.

Large Consolidated Markets Make Huge Market Cap Companies.

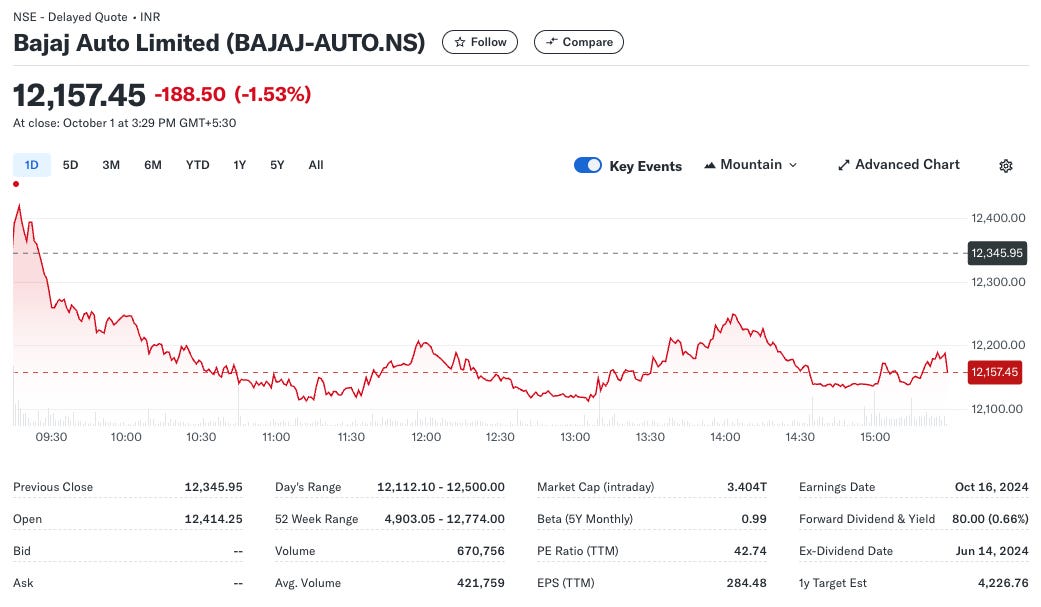

Four (out of the top six) leaders in the Indian two-wheeler market are publicly traded companies. We covered Bajaj Auto, TVS Motor and Hero MotoCorp in previous discussions and noted the considerable market caps that they enjoy. Just for fun, this is Bajaj Auto as of close on Oct 1st.

Bajaj Auto has the biggest market cap amongst the Indian two-wheeler manufacturers. At USD 40.5bn, it is by far the world's biggest pure-play two/three-wheeler manufacturer by market cap. No one comes close. As a reference, Harley has a market cap of close to USD 5.0 bn. Honda Motor Company has a market cap north of USD 51 bn and BMW has a market cap of USD 49bn but both have a car business much bigger than the motorcycle business.

Mind you, Bajaj is not the sales volume leader in India. That is Hero MotoCorp. Bajaj comes fourth. However, Hero (USD 13.7bn) comes third in the pecking order regarding market cap as it sacrifices margins for volumes. TVS Motor at USD 16.1bn is second in terms of market cap.

The huge market caps and multi-million-unit sales numbers that all these manufacturers produce every year make them fearsome should they decide to invest their financial muscle in any market or technology.

Consolidated markets mean Big Money sees Big Opportunities.

The last time we saw data on Europe, about 1,000 brands sold more than two million units. The mathematical average is a dismal 2000 units per year per brand. That means many brands are white-labelers operating within a small geography. There are numerous opportunities, all small.

In comparison, a consolidated like India presents very large opportunities. Success comes from numbers, and numbers come from setting up a nationwide distribution, sales & service. Ather Energy survived as a made-in-Bangalore and sold-in-Bangalore brand for many years before it was woken up rudely by new competition. Now, it has 248 experience centers in 168 cities.

Ather is a small player, still managing to shift 10k+ units from its showrooms. It has taken seven years from the start of sales to reach here, with most of the growth coming in the last three years. This volume growth is difficult to parallel in the developed part of the world.

Rival Ola is even bigger—it has 954 outlets in 539 cities and sells more than 30k scooters every month, all within three years of starting sales.

Big money sees this as a market that can create bigger money in a few years. The Indian customer is value-conscious and open-minded. If a startup can create the right product, money can make the front-end achieve big sales.

Mea Culpa, we oversimplified things here, but that is the core.

The Reluctance of the Incumbents

The incumbent players' reluctance has helped the new entrants. Sure, Bajaj Auto and TVS actively participate in the electric two-wheeler market. Still, their efforts and financial muscle are not even close to what they deploy to support an ICE model. The Chetak Electric and iQube are not even sold through all Bajaj and TVS outlets. Bajaj has more than 8300 outlets, and TVS has more than 7100.

Market leader Hero has been even more reluctant about electric two-wheelers. While it has a 37 percent stake, the Hero-Ather relationship is of an investor-investee with very little collaboration - product or otherwise - between the two. Hero’s electric two-wheeler venture - Vida - has been somewhat of a non-starter, and Hero has done little to change the situation.

In a market where the incumbents have decided to punch below their weight, there has been a continuing opportunity for high-quality start-ups and their investors.

Honda, the market leader in scooters, and the second largest overall in two wheelers is yet to enter the E2W market. It should within the next six months, but the Japanese have taken their own sweet time in getting into the action.

Part of the reluctance stems from the fact that the operating margins on a typical Indian commuter scooter are 20-25 percent. Those on an electric commuter scooter may be zero to minus 20 percent, depending on how you operate and how generous the government is. Hero, Bajaj and TVS are all listed companies and answerable to shareholders, something that Ola and Ather could get away without, till now.

We pause here for this week. Next week we look at the evolution of the E2W industry in India, the reasons for the rapid growth in the last two years, the fast changing landscape and what the future holds.

InsightEV’s upcoming Global Landscape and Prospects—Electric Two-Wheelers and Urban Mobility details Ola Electric, Bajaj Auto, Hero MotoCorp, TVS, and Ather Energy, along with 214 more manufacturers/startups. Please message us to request a sample.